The Pressure Of Short-Term Adjustment Of Gem Is Obvious.

< p > a few days ago, < a href= "http://www.91se91.com/news/index_s.asp" > Shanghai and Shenzhen two cities < /a > did not continue the upward trend of the previous trading day. Instead, it declined after a slight opening in early trading.

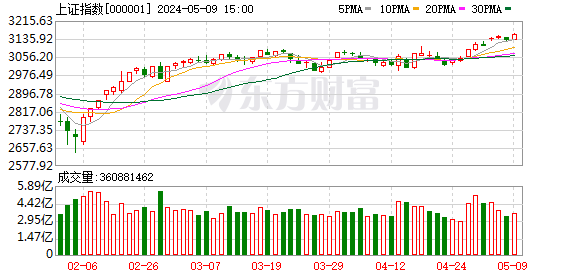

After 2 p.m., the Shanghai Composite Index accelerated downward and broke the 5 and 60 day moving average at one fell swoop.

The Shenzhen stock index index is significantly weaker than the Shanghai Composite Index. After the fall of the 5 day average line, it fell back to the 10 day average line to get short-term support.

At the same time, the volume of pactions in the two cities was smaller than that on Monday, indicating that the market sell-off began to increase.

It is noteworthy that the gem is a rapid fall in the early morning after the new high, and the short-term adjustment pressure is revealed.

< /p >

< p > from the intraday stock performance, the Shanghai stock market's rise and fall ratio is close to 1:2, the Shenzhen stock market is about 1:1.5, and the number of the gem is basically flat.

Although the market adjustment of the two cities appeared, there were still 52 stocks in the two cities.

Among them, the hot spot of Shanghai stock market is mainly based on the concept plate of Shanghai, Tianjin and other free trade zones.

Overall, the market is still focused on the theme and concept stocks speculation, cold chain logistics, nuclear power sector, Tianjin Free Trade Zone, land pfer, Tesla concept and so on are good performance.

In addition, the polysilicon plate in the industry once again encountered the United States International Trade Commission made a preliminary ruling, but suddenly rise, it is noteworthy.

At present, the main short selling pressure faced by the two cities still comes from the weighted financial sector headed by banks and securities dealers.

< /p >

< p > from the current macro economic form and < a href= "http://www.91se91.com/news/index_q.asp" > policy > /a > environment, this year's macro-economy will still be "stable". It is expected that there will not be much improvement in the first half of this year. At the same time, the market capital will not be too loose.

Therefore, the A share market does not yet have the basis of a bull market.

In the short term, the rebound of A shares is mainly stimulated by the "two sessions" approaching.

The main funds make full use of a series of favorable opportunities before the "two sessions", such as the vacuum of policy front, the entry of new shares into the empty window period, and so on.

But from the weak performance of blue chips, the market as a whole does not have systemic opportunities for large-scale strengthening.

Therefore, investors should keep the mentality of "short term participation" when participating.

< /p >

< p > the main driving force of the current market is still various subjects and concept stocks. Small and medium value market varieties are especially noteworthy.

However, once the speculation of small and medium capitalization stocks has come to an end, the market will probably enter the adjustment stage.

From the recent a href= "http://www.91se91.com/news/index_cj.asp" > stock index < /a > operation situation, the space to continue to rise is relatively limited.

First, the weak trend of weight blue chips has obviously suppressed the stock index.

Second, the Shanghai composite index is facing heavy pressure from multiple resistance areas such as the half year line and the annual line. The current market turnover has always been maintained at around 120 billion yuan, which is not enough to support the attack of stocks.

Third, although the gem has reached a new high in yesterday's intraday market, it shows signs of "top departure" both in terms of technological form and technical indicators, and the risk of short-term downward adjustment has begun to increase.

The resistance of the short-term market is near the 2150 point, and the support is near the 10 day moving average.

In terms of operation, it is suggested that investors should make appropriate profits for the recently increased varieties, and not be too hot to catch up with the market.

< /p >

- Related reading

- Visual gluttonous | In Winter, There Are Beautiful Shapes And Beautiful Shapes.

- Equipment matching | High Speed And High Efficiency Of Zhonghui Textile Machine Intelligent Roving Frame

- Equipment matching | Textile Machinery: Optimization Of Air-Jet Looms

- Innovation and invention | The New Revolution Of Multi Spectral Camouflage Clothes To Refresh Stealthy Clothes

- Fashion item | Slim Jacket, Hot Recommendation, Easy To Match With Fashion Fan.

- Popular color | Beautiful And Colorful, Dressed In The Horse Year And Wearing A New Impression.

- Popular this season | 2014 Spring And Summer Popular Purple Phalaenopsis

- Fashion blog | How To Wear Winter Clothes Show The Most IN Match

- Collocation | Warm And Charming Winter Dress Is Elegant And Refined.

- Fashion makeup | The Use Of Winter Liquid Foundation To Make The Makeup More Suitable.

- 怎樣理財才能存下錢

- Half A Dozen Shops In The Middle Part Of Huaihailu Road In Shanghai Evacuated For Half A Year.

- Local Outdoor Brand High Price Admission To The Famous Exhibition "Beijing ISPO"

- The More Clear The Share Price Of Gem, The Higher It Is.

- 2014 G+BG Brand Autumn Suit Will Be Held In Hangzhou.

- Li Yang, A Chinese Designer, Was Selected For The LVMH Young Designer Grand Prix.

- 2014 Warm And Pure Autumn New Product Release And Ordering Meeting Will Be Held On 03 15.

- Small Loan Companies Regulatory Policy Or Will Usher In An Important Breakthrough.

- The Gem Is Limitless In The Perilous Peak.

- Foreign Trade Situation Is Heating Up, Quanzhou Shoe Export Orders Continue