Soochow Securities: The Market Will Face Greater Pressure.

Soochow Securities: the market will face greater pressure.

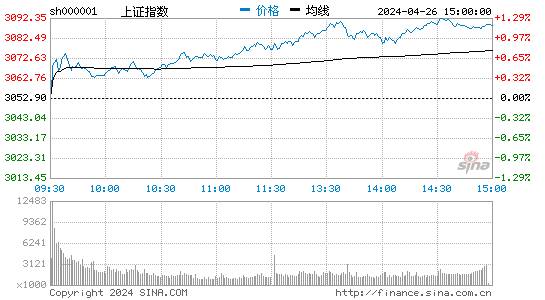

On Monday, the market reproduced a small adjustment pattern.

Specifically, morning

Shanghai Composite Index

After a small opening, it gained strong support near the 5 day moving average, followed by a slight rebound trend along with the announcement of the economic data. However, due to the lack of a follow suit, the volume of the two cities was obviously insufficient, and the afternoon market sell-off began to increase, and the stock index once again returned to the 5 day moving average.

From the disk side, most of the plates fell.

Among them, agriculture, forestry, animal husbandry, fishery, LED, nuclear power, cloud computing and other sectors are among the top down, but the overall decline of the plate is within 2%. In terms of stocks, although the market has adjusted, the market trading opportunities still exist. The two cities still have Jinshan Development [7.13 10.03% shares, research report], and red bean stocks [4.76 9.93% shares, bar Research Report] and so on.

Judging from the last two trading days, stock index

Fluctuation interval

Again narrowing, stock index fluctuated slightly between 2284-2309 points.

From the technical indicators, the Shanghai Composite Index has 10 day average repression, under the 5 day average line support, short-term trend is not warm.

At the same time, from the disk, the performance of plates and stocks has also been differentiated.

On the one hand, although real estate, non-ferrous metals, brokerages, insurance and other sectors have been active, but failed to form a resultant force, market willingness to follow suit is not strong, on the contrary, banks and coal oil plate is weaker than the market; on the other hand, stocks, the main funds in the early intervention of deep stocks in the recent rebound performance is better, but the two cities still have more than 30% of the stock performance is weaker than the market.

At the same time, the recent market performance of high sending and pferring stocks also appeared obvious differentiation. Some stocks were reported on the same day at the price limit, but some individual shares closed down.

For the above phenomenon, we think this is the characteristic of the technical rebound, and also indicate that the market is cautious about the future market.

Economic data is not good or bad.

Today's important economic data show that CPI rose 3.6% in March compared with the same period last year.

On the one hand, it is driven upward by 0.2% of the tail factor; on the other hand, consumer goods prices rise by 0.3%, reflecting the impact of rising oil prices and rising labor costs, the driving force for non food prices has increased.

At the same time, PPI appeared 0.3% negative growth, taking into account the persistence of rising labor costs, and international oil prices at a historical high level, coupled with resource price reform and other factors, it is predicted that the future CPI will have relatively little downward space and maintain a judgement of 3.5% above the whole year. But for PPI, we think that considering the decline in demand for international raw materials such as commodities, the impact of upstream prices on PPI will continue to fall, which may be a departure from the trend of CPI.

Against this background, the space for deposit interest rate reduction is basically relatively limited, and there is little room for monetary policy adjustment.

The stock index will return to its original trajectory.

The recent rebound in the broader market is mainly driven by news stimulus and technology overfall. However, we have repeatedly suggested that good policies will not change the market's original trend of operation, and at the same time, technological rebound is also a flash in the pan.

With the announcement of important economic data today, short-term news will be calm again, and the stock index will return to its original trajectory.

From the technical indicators, at present, 5, 10, 20 and 30 days average is still downward downward alignment, taking into account the amount of this rebound can be relatively short, it is expected that the market will face greater follow-up.

Throwing pressure

。

And from the short term, after several trading days after the rebound, the current market 30 minutes and 60 minutes KDJ is at high passivation, short-term shocks or callbacks have greater probability, so it is recommended that investors still need to strictly control positions.

- Related reading

Stock Market News: Stock Index Fell 0.9%&Nbsp; CPI Data Suppressed Bull Sentiment.

|- Fashion makeup | Korean Light Makeup Simple Tutorials Novice Make-Up Selling Magic Weapon

- financial news | Agencies To Raise 14 Of The Next Year, The Closing Rate Of Base Discount Rate Is Obvious.

- Expert commentary | Tight Funds To Suppress A Shares Rebound

- Company news | ZOJE Sewing Machine Takes The Heavy Load Of Equipment Big Country

- Female house | DKNY 2014 Early Autumn Women'S Wear Series Fashion Release

- Men's district | MARKAWARE 2013 Autumn Winter Series Fashion Release

- Fashion makeup | Lovely Makeup, Purple, Big Eye Makeup Is Charming.

- Fashion brand | 2013/14 Autumn And Winter New "Sella Lady" Handbag Series Released

- Street shooting popular | Fashion Trend Street Fashion Easy To Create Big Temperament

- Enterprise information | Antarctic Conference Held Huang Haibo Pro Scene

- Stock Market News: Stock Index Fell 0.9%&Nbsp; CPI Data Suppressed Bull Sentiment.

- Comparison Between Sports Brand Lining And Nike

- Listed Companies Are Now Laying Off Workers: Home Appliances, Textiles And Other Industries Become The Worst Hit Areas.

- Guo Weiqing: Middle Income Is A Pie &Nbsp, Or A Trap?

- Zhu Hai: Why Is China'S Happiness Index Lower Than Russia And India?

- Sandals Appeared In The First Half Of The Month In &Nbsp; The Average Price Was 20% Higher Than Last Year.

- Europe'S Currency Fell &Nbsp, And The US Dollar Gained Strength.

- Global Financial Markets A Big Theme On Friday

- Sports Brand Endorsement: Grassroots Marketing Strategy

- China's Banking Industry Is Facing Credit Risk.