From Inventing Flash Memory To Having Only One Seedling, What Has Japanese Storage Companies Experienced?

As a global "supplier" of raw materials, storage capacity increase and decrease of the original factory has almost controlled the mood change of the whole downstream market.

As a result, any disturbance between the original plants has attracted much attention. At present, NAND flash and DRAM are the two major flash markets in the field of flash memory. The latter is in a highly centralized state, and more than 90% of the shares are controlled by the three major global manufacturers. The former is in a relatively decentralized state of competition, but it is hard to say in the future.

The original factory of Japanese storage, chivalrous, is also the inventor of NAND. After being sold by Toshiba to Bain Capital, an American investment institution, it has tried to capitalize in the past two years.

Jiaxia's market share in NAND ranks second. Many industrial chains don't want to see too concentrated market in the future. It is difficult for independent IPO to go into operation, which leads to doubts about the development direction of Jiaxia. It is also worth noting that Japan used to be a big storage country in the world, but in the course of decades of development and change, it has gradually sold its storage business. Today's chivalrous man is the "only child" left in the history of Japan's storage hegemony.

What did they go through?

Loose NAND pattern

In the rising price of upstream devices, memory is facing the same situation. Just because the original factory controls the core of the balance between supply and demand in the industry, it directly affects the DRAM and NAND flash markets, and then it will face the demand prospect of two hot days.

This may affect the pattern transformation of the original factory of flash core.

Due to the relatively cautious investment in DRAM market in the early stage of the original factory, under the wake-up of the current huge demand, the senior managers of the original factory generally believe that the supply and demand will be in short supply next; however, due to the harvest period of investment and production in NAND, it is estimated that the market supply and demand will be stable in the second quarter of 2021.

From the perspective of performance, the stability of NAND demand means that the income fluctuation is not big for the original storage factory. As for the armored man, he may face more difficulties.

Chen Jun, deputy general manager and chief analyst of sigmaitell, told the 21st century economic report that the mobile phone flash memory business of Jiaxia accounts for 40% of the total revenue. Huawei has always been a big customer. Affected by the changes in the international environment, the supply of Jiaxia is facing difficulties.

"According to sigmaitell, the industry price of the split 128GB was about $14 in the fourth quarter, down about 4.8% from the third quarter." As a result, sharp changes in the external environment and its own business strategy make it difficult for Jiaxia to obtain sustainable competitiveness in the market competition. Bain Capital, as its major shareholder, will be more eager to make profits through M & A or IPO as soon as possible, Chen Jun told reporters.

Some people in the storage industry told the 21st century economic report that in SSD (solid state drive), flash memory (flash) will determine its cost and performance. "Therefore, a SSD supplier needs to have large-scale production capacity to ensure supply; at the same time, it should be able to reduce costs; it should also have leading flash technology, which can provide high-performance, self-control controllers and components to vertically optimize SSD products, and provide consistent and stable high-performance, not just high-performance at a certain time or peak."

This is the reason why some original factories adopt the way of joint venture to build factories to promote business, and it is also in the history of memory development that companies with continuous losses through mergers and acquisitions have formed the current high concentration situation.

Head leopard Research Institute analyst Xie Zibo told reporters that at present, Intel's market share of NAND and that of Jiaxia are not in the same order of magnitude. The annexation of Jiaxia by any peer enterprise will cause great changes in the market pattern.

"As one of the few memory chip manufacturers in Japan, it is of great strategic significance to Japan. The existence of Kaixia is not only related to the survival of the enterprise itself, but also related to Japan's strategic layout for the development of its semiconductor industry and the ownership of relevant core technologies. The acquisition and merger of Jiaxia will be strictly examined by the Japanese authorities. In addition, if Jiaxia is acquired by South Korean forces, it will lead to Korean manufacturers occupying most of the market share of NAND flash and reappear the global DRAM market competition pattern. Therefore, the strategic layout of NAND flash memory in various countries may become one of the key factors restricting Jiaxia's acquisition and merger by peers. " He continued.

Chen Jun also believes that the industry's attitude towards the acquisition of Jiaxia is not optimistic because of its global status, which makes it difficult to avoid antitrust law (i.e., monopoly law) if it is acquired by peers. "At the same time, SK Hynix also holds the shares of Kexia through Bain Capital. The merger and acquisition of Jiaxia by other industries is bound to meet the great resistance of SK Hynix. If the extreme situation occurs, the competition pattern of NAND market will change from single oligarchy (Samsung) to duopoly competition pattern, and South Korea and the United States may basically control the global NAND supply. "

How Japan lost

In the history of semiconductor industry transfer, Japan and South Korea are undoubtedly the important foothold of the second transfer, and from the perspective of development period, Japan is actually ahead of South Korea.

The turning point appeared around the 1980s. At that time, Japan once occupied more than 50% of the global market share in the field of memory chips. At its peak, Japan electric, Toshiba and Hitachi ranked among the top three in the field of dynamic memory.

This was quickly noticed by the United States and initiated an anti-dumping lawsuit against Japan. Since then, Japan and the United States reached an agreement, forming a constraint. However, South Korea quietly cultivated Samsung and vigorously expanded its production during this period. After its development plan was approved by the United States, it gradually stepped onto the fast track of memory development.

Hu Junjie, an analyst at the head leopard Research Institute, told the 21st century economic report that to gain a foothold in the storage industry, it is necessary to master the intellectual property rights of cutting-edge technologies and mass production capacity at the same time. Driven by technology, the storage capacity increases exponentially, and the winner takes all situation before and after technology generation difference. In order to prevent the existing capacity from being eliminated by technological progress, manufacturers are forced to invest heavily in R & D, which is never enough.

"Therefore, the only way to stay in the memory market is to expand production capacity and reduce price sales. As a vicious circle, manufacturers have extremely limited space to avoid market risks. If overcapacity and expected demand decline, the investment in R & D and expansion will be wasted. Bankruptcy exit will be the best way for most manufacturers to stop loss. " He added that under the background of this industry, Japanese enterprises once firmly settled in the semiconductor storage field, under the double restraints of the sharp appreciation of the Japanese yen exchange rate and the penalty tariff imposed by the United States in 1986, their market share fell precipitously and flowed into the hands of South Korean enterprises that invested and expanded their production in a counter cyclical way. As a result, Japanese memory chip enterprises have gradually lost their dominant position in the global market.

Chen Jun pointed out that in addition to the compromise with the United States, the loss of Japan in the later period was also related to its corporate culture. "Japanese enterprises are good at continuously leading research and investment in technology, but they are not flexible enough to cope with market changes. In contrast, in addition to the continuous investment in technology, American and Korean enterprises are more flexible in their competitive advantages. They are especially good at analyzing market demand changes and gaining more market share through flexible market or product coping strategies. "

Today, Katsuma is the only giant left in the development of memory in Japan. Its capitalization outside IPO will undoubtedly lead to tsunami impact.

Xie Zibo pointed out that in extreme cases, if Jiaxia is really acquired by other NAND big factories, it will mark the loss of Japan's once proud memory chip market after DRAM, and also marks the end of Japan's regret from the global memory market. The layout of Japan's semiconductor industry will leave only the upstream industries such as semiconductor manufacturing equipment and materials.

"As soon as Jiaxia, which has nearly 20% of the market share, is acquired by the industry leader, NAND flash production capacity will be further concentrated, and the United States and South Korea will monopolize this market. The improvement of concentration and the concentration of regional distribution of production capacity will enhance the bargaining power of NAND leading manufacturers, and the survival space of tail enterprises may be further squeezed. " He added.

?

- Related reading

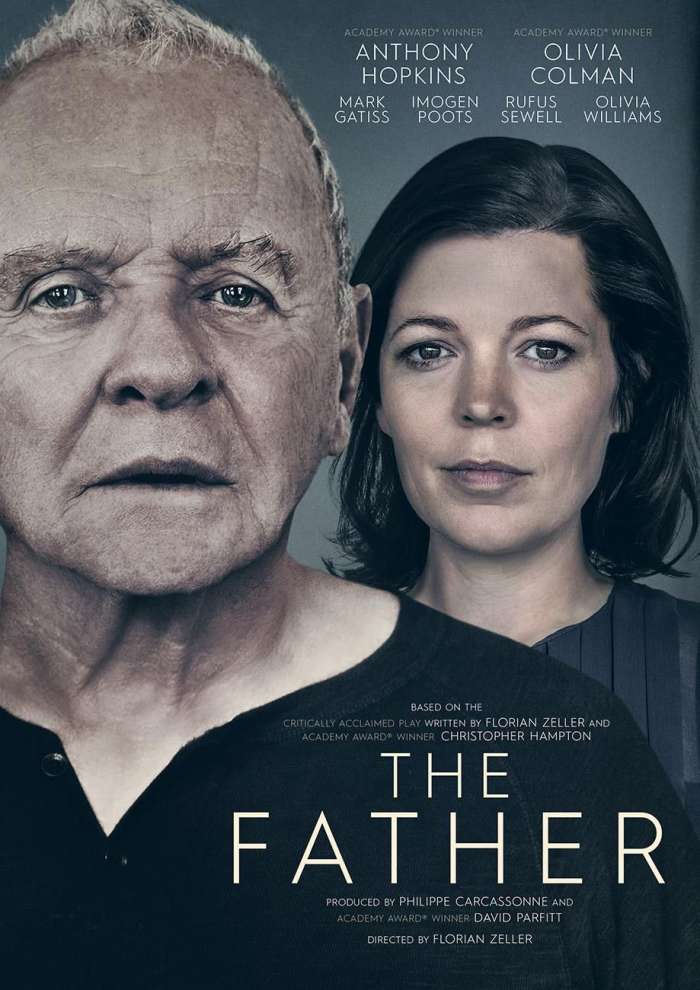

Father Trapped In Time: Seeing The World From The Perspective Of Alzheimer'S Disease Patients

|- Local businessmen | China New Network: Chinese Textile And Garment Young Entrepreneurs Talk About Digital Going Out To Sea

- | Congratulations On The Grand Opening Ceremony Of Guangdong Xihuagui Liquor Co., Ltd

- Dress culture | Kapok Road: The Beautiful Traditional Hair Ornaments Are Poems On Women'S Heads

- Market trend | China Textile City: Spring And Summer Elastic Fabric Transaction Varieties Increase

- quotations analysis | Fundamentals Improved, Cotton Market Rose This Week

- Professional market | PTA Production Continues To Decline, Polyester Production And Sales Remain Weak

- Market trend | Standing At The Air Outlet Waiting For The Guidance Of The Yarn

- Industry perspective | Report On The Development Of China'S Industrial Textiles Industry In 2020

- regional economies | Production Capacity And Demand Development Of Nonwovens In Southeast Asia

- Market topics | Pakistan'S Textile Exports Increased By 9.06% In The First Nine Months Of This Fiscal Year

- Who Will Become The Intelligent Machine Of Automobile Industry After Huawei Enters The Bureau?

- Dividend Competition Of New Domestic Products: From Competing For The Post-95 Market To Going Out To Sea

- Sweden'S Clothing Retail Shows Cautious Optimism In March

- Customs AEO Helps Cotton Textile Enterprises To "Enter And Export Well"

- How About Xinjiang Long Staple Cotton This Year?

- Multiple Factors Restrict Cotton To Keep "Cattle Hide" Market

- Xinjiang: Spring Sowing Has Been Carried Out

- Shishi International Textile City Awarded 2021 "Top Ten Textile Markets In China"

- 2021 Shangrao Textile And Garment Industry "Ten Thousand Miles Of Market Development" Activity Held

- Great Wall Securities Textile And Clothing Industry Zero Data Review In March