European And American Stocks Are Mixed, Pointing Out That The Yuan Continues To Boom.

According to the world

clothing

Shoes and caps net learned: on Thursday (January 5th), European and American stocks were mixed. The Nasdaq was high, the US dollar fell 1.3%, gold rose to 1 months high, crude oil rose slightly, the RMB rose for second consecutive days, and offshore is now 6.7945.

Follow the Xiaobian to pay attention to the euro area economic index in December at 18:00.

Market context

The offshore RMB exchange rate has gained the largest two days since its launch in 2010, and the offshore renminbi has surged more than 700 points to 6.7890 against the US dollar.

US dollar to RMB exchange rate trend (yellow line: on shore; white line: Offshore)

The offshore renminbi closed at 6.8817, up 668 points from yesterday's official closing price, setting its biggest one-day gain in nearly 11 months.

At 23:30 on the 5 th, it closed at 6.8830 yuan at the end of the night market. Compared with the previous trading day, the night closing price rose 476 points, and the volume of the whole day increased by 146 million US dollars to 26 billion 570 million US dollars.

The central parity of RMB against the US dollar was 6.9307, which rose by 200 points over 6.9526 of the middle price of the previous day. However, the domestic price of RMB CNY was much lower than that of the overseas market.

The US dollar fell to a three week low against a basket of major currencies on Thursday, while the US dollar fell against the yen, the euro and the Swiss franc.

US job market data are mixed.

Dollar index time-sharing trend

The US dollar index fell 1.3% to 101.300 lows, recording the largest single day percentage drop in September 6th.

The US dollar fell to 1.4% against the Japanese yen in late New York, hitting the lowest level in December 14th, while the US dollar fell by about 1% against the euro and the Swiss franc, all hitting the lowest level in December 30th.

[oil market] oil price shocks rose sharply, and were boosted by the sharp decline in EIA crude oil inventories in the United States and Saudi Arabia's performance in the OPEC agreement.

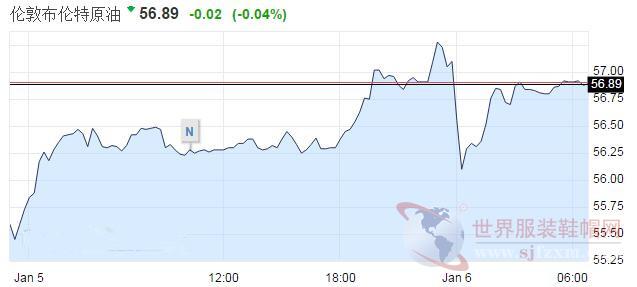

Time share trend of Brent crude oil in the US

US crude oil futures rose 0.50 US dollars or 0.9%, at $53.76 a barrel.

British Brent crude futures rose 0.43 US dollars or 0.8%, at $56.89 a barrel, hitting 57.35 US dollars in intraday trading.

Gold prices climbed to a one month high as the dollar fell further from its 14 year high hit earlier this week.

Platinum hit nearly eight weeks high, probably the largest weekly gain since July.

Time trend of gold price

Spot gold rose 1.5% to $1180.94 an ounce.

This week is expected to rise 2.5%, the biggest Zhou Shengfu in June.

In February, gold closed up 1.5%, at $1181.30 an ounce.

Spot platinum rose 2.8% to $966.20 an ounce, hitting nearly 975.80 dollars in the past eight weeks.

This week is expected to rise 7.9%.

Spot Silver Rose 0.85% to $16.56 an ounce.

[stock market] US stocks ended 4 consecutive gains, closing and trading, and the NASDAQ index closed at a record high.

European shares closed slightly higher, traders are still digesting the minutes of the 2016 December monetary policy meeting released by the Federal Reserve, and took a cautious stance on stock market investment.

Nasdaq 100 index time-sharing trend

The Dow Jones Industrial Average fell 42.87 points or 0.21% to 19899.29 points, and the standard & Poor's 500 index edged down 1.75 points or 0.08% to 2269 points.

The NASDAQ index rose 10.93 points or 0.2% to 5487.94 points, less than 1 points higher than the previous record high of 27 in December.

Pan European Storck 600 index rose 0.1%, closed at 365.64 points, the French CAC 40 index closed slightly rose, reported 4900.64 points, the British FTSE 100 index closed up 0.1%, reported 7195.31 points.

Trade leads

[renminbi] Zhou Hao, a German Commerzbank, believes that there are no obvious signs of intervention from the disk.

CNH suddenly strengthened, reflecting the choice of the market.

[exchange market] "if you want to identify the inducements, it is China (RMB rise)... It has triggered an avalanche effect, which has pushed many positions favorable to the US dollar at the beginning of the year," said Alan Ruskin, global head of Deutsche Bank's foreign exchange strategy division.

[oil market] US government data show that the US crude oil net position held by upper cycle cargo speculators is the highest in 2014.

However, OPEC's task of reducing production is still very arduous. Reuters survey data show that OPEC's output in December is far higher than the level reached by agreement.

[Jin Shi] "the unemployment rate announced in the morning is higher than expected, helping to support gold and suppress the US dollar," said Miguel Perez-Santalla, vice president of Heraeus Metal Management.

[stock market] "the market is waiting, waiting for approval from Washington and Trump's work arrangements," said Jeff Zipper, managing director of U.S. Bank's Private Client Reserve.

Data and speech

[Caixin PMI in December hit a new high of nearly four years. In December, Caixin China integrated PMI 53.5, the fastest growth in nearly 6 years.

The total volume of new orders has been the highest since March 2013, and economists say that all year's economic goals are unobstructed.

The US labor market shrinks. The ADP employment data known as "small non-agricultural" in the United States increased by only 153 thousand people in December, significantly lower than the previous value, far less than expected.

The GDP contribution of the US service industry continued to expand. In December 2016, the US ISM non manufacturing index was higher than the expected value, unchanged from November.

Statistics show that the economy is expected to sweep off the previous quarter's weakness in 2017.

EIA crude oil inventories fell sharply in December 30th. The US crude oil inventories in December 30th were -705.1 million barrels, the biggest drop since September 8, 2016, and -215.2 million barrels were expected, the former value was +61.4 million barrels.

Finance

Focus News

RMB exchange futures: Hongkong Stock Exchange: USD to RMB futures today reached 20338, with a nominal value of more than US $2 billion.

[skyrocketing by 2139 basis points, overnight HIBOR surged to 38%] the overnight interest rate of offshore renminbi Hibor in Hongkong soared by 2139 basis points.

Zhou Hao, a German Commerzbank, pointed out that the offshore renminbi trend reflects a new attitude of the central bank. As long as it does not want to provide too much liquidity, the market will continue to show tighter liquidity, making the cost of shorting the renminbi increase substantially.

[bitcoin exchange price in China is suddenly flashover] domestic famous trading platform fire currency net, OKCoin and other quotes, the highest price of bitcoin in the intraday market is close to 9000 yuan, then plunged rapidly, once fell to 7100 yuan up and down, fell more than 20%, after the decline narrowed.

Saudi Arabia has fully implemented its responsibility for reducing production. Saudi Arabia has implemented its production reduction plan since October last year, reducing production by 486 thousand barrels per day and limiting crude oil production to 10 million 58 thousand barrels per day.

News came as oil prices recovered and all day declines were recovered.

Economic Calendar

15:45 French trade account November

18:00 euro zone December economic climate index, euro zone December industrial prosperity index

18:00 euro zone December consumer confidence index final value, euro area retail sales month rate in November

21:30 U.S. 12 monthly adjusted non farm payrolls, December unemployment rate, November trade account

23:00 US factory order month rate November

The next day, 00:15 Federal Reserve 2017 FOMC vote Committee Evans delivered a speech.

Next day 02:00 us to January 6th week oil drilling total feedback

More financial highlights

information

Please pay attention to the world clothing shoes and hats net.

- Related reading

Alibaba: Taobao Will Adjust Its Organizational Structure Under The New Retail Trend.

|

2016 Is About To Take Stock Of 9 Major Pain Points In China's Apparel Industry

|- Market trend | By The End Of June, At Least 1 Million 450 Thousand Tons Of Cotton Had Not Yet Been Sold.

- Local hotspot | Lanxi Will Spend Three Years Building A Model Of Textile Intelligent Manufacturing.

- quotations analysis | PTA The Afternoon Limit Is 5596 Yuan / Ton.

- Entrepreneurial path | How To Combine The Basic Operation To Prevent Mechanical Defects Of Spinning Workers

- quotations analysis | Spandex Industry Staged "Ice And Fire Double Days": Overall Profit Decline, Leading Performance Growth

- Market trend | 7-9 Month Cotton Yarn Market Trend: Cotton Yarn Or Will Take The Lead To Stabilize

- Domestic data | Sino US Trade War: Asian PX Market Deducts Roller Coaster Market In The First Half Of 2019

- Finished shoes | COZY STEPS LAB落戶西安 開啟真我生活新領地

- market research | Male Consumption Has Been Neglected For 95 Years.

- market research | Is The Real Economy Failing?

- Schiaparelli And Julienfourni Are Awarded The Brand Name Of The Advanced Custom Fashion Designer.

- How Can The British Clothing Brand Be Faster Than Zara?

- WAL-MART Acquired Jet.Com, An E-Commerce Company, To Buy Shoe Online Retailers.

- Is Louis Vuitton Ready To Create The Future With Supreme?

- Giving Gifts To Health, 2017 Shanghai Gift Show Leads The New Trend Of Healthy Life.

- What Big Events Happened In LVMH In 2016?

- The Second China (Shenzhen) International Fashion Festival Opening Today'S Four Major Points Of View

- [2017.01.05] Quotation Analysis Of Daily Quotations Of The Silk Road

- "International Fashion And Big Coffee Coming, Gathering In Shenzhen To Open A Forum" - China (Shenzhen) International Fashion Festival International Fan Shizu

- The Second China (Shenzhen) International Fashion Festival Opens Today. Dialogue Between City And Fashion Triggers New Thinking In The Industry.