Industrial Cluster: Analysis Of Economic Operation Data Of China'S Linen Textile Industry

In 2024, facing the complex and severe situation of increasing external pressure and internal difficulties, the hemp textile industry, as a niche industry with unique historical classics and people's livelihood, will give full play to the comparative advantages of industry resources, production and international trade, and still achieve good economic benefits. According to the data of the National Bureau of Statistics, in 2024, the main economic performance indicators such as the operating income, total profit and export delivery value of enterprises above designated size in the linen textile industry will all increase significantly year on year. The scale of flax spinning spindles will approach 800000, accounting for about 70% of the global flax fiber processing capacity. The scale of hemp, ramie, jute and other fiber textiles will also rise steadily. According to the data of China Customs, the export value of hemp textile products excluding hemp clothing and accessories in 2024 will increase by 27.1% year on year, and the industry enterprises will make good profits.

1、 Basic information of linen textile industry in 2024

According to the data of the National Bureau of Statistics, the operating income, total profits, total assets, total current assets and export delivery value of linen textile and dyeing and finishing enterprises above designated size in 2024 have all achieved a higher growth than that in 2023, respectively 17.52%, 15.9%, 9.1%, 13.1% and 8.1%, which is far higher than the overall level of the textile industry and textile industry in the same period, as shown in Figure 1. This is related to the rise in the price of raw materials in the international market, not to mention the advantage of meeting the demand for consumption upgrading brought about by the unique performance of hemp textile products, the advantage of the complete industrial chain of the domestic hemp textile industry, and the new advantages of production and trade brought about by the innovation of enterprise equipment, technology and process.

Figure 1 Comparison of year-on-year growth of major economic indicators of linen textile industry in 2024

Source: National Bureau of Statistics

From the quarter on quarter data, in the first quarter of 2024, the profit growth of enterprises above designated size in the linen textile industry dropped significantly compared with the fourth quarter of 2023, mainly due to the impact of the New Year holiday; In the second quarter of 2024, the profit level of enterprises turned positive month on month, and turned negative month on month in the third quarter (see Figure 2). The main reason is that the huge changes in raw material supply in the past two years have led to a huge shock in flax and hemp raw materials, which has triggered a sharp change in the market. From 2023 to 2024, the "double sky of ice and fire" of European flax fiber has brought "turbulence" to the production and operation of enterprises in the industry. In the fourth quarter of 2024, the export delivery value of enterprises has a relatively high month on month growth, which is related to the seasonal characteristics of the operation of the hemp textile industry. It also does not exclude the impact of factors such as the rush to ship goods at the end of the year and the imposition of tariffs on imported products by the new US president.

Figure 2 Statistics of month on month growth of main economic indicators of linen textile industry in 2024

Source: National Bureau of Statistics

By comparing the quarter on quarter data of major economic indicators of hemp fiber and textile processing and spinning industry in 2024, it can be seen that the fluctuation of raw material prices has a more obvious impact on upstream spinning links, and the fluctuation of prices has a greater impact on spinning enterprises. The changes in the main economic indicators of the hemp weaving and processing industry are more consistent with the changes in the economic indicators of the hemp textile industry, which is related to the industrial chain link where the hemp weaving and processing industry is located.

In addition, according to the data of the National Bureau of Statistics, in 2024, the year-on-year growth rates of operating costs, sales expenses, administrative expenses and financial expenses of linen textile industry enterprises were 18.24%, 9.65%, 10.61% and 4.42% respectively, and the corresponding indicators of textile industry in the same period were 3.33%, 5.06%, 4.23% and -5.20% respectively. Comparing these indicators reflecting the level of enterprise operation and management, we can see that, The hemp textile industry enterprises have performed well in the profit indicators. At the same time, due to the substantial rise in raw material prices, the operating costs, administrative expenses and financial expenses of enterprises have increased significantly. The operation and management efficiency of hemp textile industry enterprises has room for improvement, which is also the driving force for industry enterprises to improve their core competitiveness and promote high-quality development of the industry.

2、 Analysis on import and export of linen textile industry in 2024

The hemp textile industry has many categories (flax, hemp, jute, ramie, etc.), small size, prominent "two ends out" characteristics, and high dependence on foreign main raw materials. In 2024, 195000 tons of flax fiber and staple fiber will be imported, 29621 tons of jute fiber and staple fiber will be imported, and 9275 tons of hemp fiber and staple fiber will be imported. Among them, in 2024, the import volume of beat flax was 93500 tons, a sharp decrease of 35% compared with 143200 tons in 2023, and the import volume of short flax in the same period was 98900 tons, which exceeded the import volume of beat flax for the first time in history; Compared with 2023, the import volume of hemp fiber and jute fiber also increased significantly, 114.46% and 77.80% respectively. The reason is that the failure of flax harvest in Europe in 2023 led to the shortage of raw materials for flax beating and the rise of prices. Enterprises sought alternative raw materials for flax beating and flax blending, and some products shifted from pure flax to flax blending, which led to an increase in demand for second coarse flax and other hemp fibers.

In 2024, the export volume of flax textile products (including fiber, yarn, fabric and products) will be 2.381 billion US dollars, up 27.13% year on year from 2023, of which the export proportion of flax textile products will be about 80%.

(1) Import of main raw materials for linen spinning

1. Flax fiber import

Statistics from the National Bureau of Statistics and China Customs on the import and export of flax fiber show that China's flax and jute fiber mainly rely on imports. Among them, the import of flax fiber is relatively stable, about 200000 tons in the past five years, accounting for 80% of the import of flax fiber (flax, ramie, hemp, jute). In 2024, China's flax fiber imports will total 195000 tons. As the flax harvest failure in 2023 led to the shortage of raw materials for beating flax, the demand for short flax increased. In 2024, the import volume of short flax exceeded that of long flax (beating flax) for the first time in history. See Figure 3

Figure 3 Statistics of China's flax fiber imports from 2020 to 2024 (tons)

Source: China Customs

Country of flax fiber import

From the perspective of importing countries, France, Belgium and Egypt will still be the main importing countries of flax fiber in China in 2024. More channels are sought due to the shortage of raw materials. In 2024, the import volume of flax fiber from Russia and Russia will increase, and the import from Vietnam is mainly flax staple fiber which is initially processed in Vietnam. The main countries of flax fiber import in 2024 are shown in Figure 4.

Figure 4 Country Statistics of China's Flax Fiber Import in 2024

Source: China Customs

Import price of flax fiber

In 2023, the flax harvest in Europe will be poor, and in 2024, the number of flax fiber beaten into flax imported by China will decline significantly. But in 2024, European flax harvests again, and the output of long fiber sets a historical record. Therefore, in the fourth quarter of 2024, the price of flax fiber began to fall sharply, causing a certain degree of panic to the market. See Figure 5 and Figure 6

Figure 5 Statistics of China's flax imports from 2022 to 2024

Source: China Customs

Figure 6 Statistics of China's Second Crude Flax Import from 2022 to 2024

Source: China Customs

The relationship between supply and demand affects the price. Because Europe and Egypt have significantly increased the area of flax planting in 2024 and achieved a bumper harvest, the price of flax fiber has stopped rising and returned to normal market prices. It is expected that the price of flax will fluctuate sharply due to the influence of raw material supply, but the speed is too fast for enterprises to adapt. From the current situation, the prices of flax fiber, yarn and grey cloth will be at the bottom in 2025, and the market will return to normal. The domestic market demand is expected to increase significantly compared with that in 2024.

The rise in the price of beaten flax in 2023 and the shortage of beaten flax in 2024 brought about the increase in the demand for second crude flax. It can be seen from the figure that from 2023 to 2024, the change trend of the import quantity and price of the second roughage of flax corresponds to the change trend of the import quantity and price of the beaten flax.

2. Cannabis fiber import

With the development of China's hemp fiber textile industry and the promotion of hemp products, the market demand for hemp fiber is also increasing year by year. In recent years, the import of hemp fiber in China has shown a rapid growth trend (see Figure 7). In 2024, 9275 tons of hemp fiber and staple fiber will be imported, an increase of 115% over 2023. The importing countries include France, Belgium, Canada, Russia, Germany, the Netherlands and the United States. With the substantial increase of cannabis cultivation area in Northeast China in 2024 and the easing of tension of flax raw materials, the growth rate of cannabis raw material import is expected to decrease in 2025.

Figure 7 Statistics of China's hemp fiber and staple fiber imports from 2020 to 2024

Source: China Customs

3. Jute fiber and yarn imports

China's jute fiber is mainly imported from Bangladesh, and a small amount is imported from the Philippines and India. In 2024, China will import 29621 tons of jute fiber, an increase of 77.8% over 2023, hitting a new high in jute fiber imports in the past five years. Among them, 28775 tons of jute fiber was imported from Bangladesh, accounting for 97.1% of the total import volume. In 2024, China will import 110382 tons of jute yarn, slightly less than the same period last year. See Figure 8 and Figure 9.

Figure 8 Statistics of China's jute fiber and staple fiber imports from 2020 to 2024

Source: China Customs

Figure 9 Statistics of China's Jute Yarn Import from 2020 to 2024

Source: China Customs

(2) Import of main raw materials for linen spinning

In 2024, the export value of China's hemp textile products will be 2.38 billion US dollars, an increase of 27.1% over 2023. From 2020 to 2024, the average annual growth rate of export value of flax, jute and hemp textiles is double digits, except that the average annual growth rate of export value of ramie textile products is negative. In 2024, China's hemp textile products will be exported to more than 180 countries and regions, and the export products mainly include all kinds of hemp yarn, fabrics, linen bedding, linen table, toilet and kitchen supplies.

1. Linen textile exports

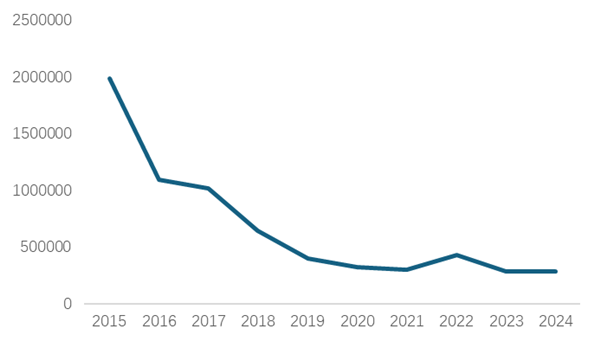

In the export of flax textile products in 2024, the export value of flax yarn and fabric will account for 79.3% (see Figure 10). Among them, 17900 tons of flax yarn was exported, with a slight year-on-year increase of 1.75%, and the export amount was 292 million dollars, with a year-on-year increase of 21.22%. Linen fabric exports totaled 340.71 million meters, including 71.37 million meters of pure linen fabric and 24.256 million meters of linen blended fabric, with year-on-year growth rates of 7.74%, -9.72% and 14.25% respectively; The year-on-year growth rate of export amount was 30.83%, 22.82% and 39.46% respectively.

Figure 10 Statistics on the proportion of China's hemp textile exports in 2024

Source: China Customs

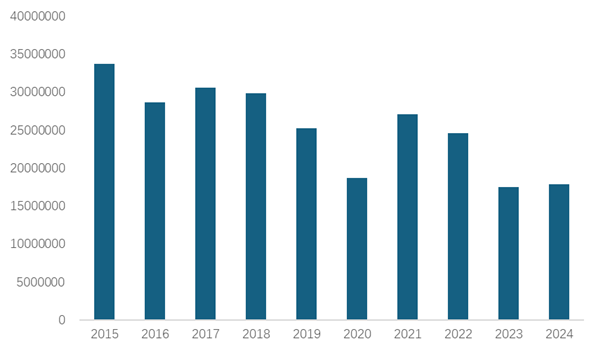

Although the export volume of pure flax yarn and pure flax fabric showed a downward trend due to the reduction of raw material production, the export amount of pure flax yarn still achieved a significant increase due to the price rise. Flax blended fabric has grown rapidly in recent years, making up for the impact of the shortage of flax raw materials. See Figure 11 and Figure 12

Figure 11 Statistics of China's flax yarn export from 2015 to 2024 (kg)

Source: China Customs

Figure 12 Statistics of China's linen fabric exports from 2015 to 2024 (m)

Source: China Customs

According to the statistics of Chinese customs, in 2024, China's flax yarn exports will be mainly concentrated in India, Italy, Turkey, Portugal, Bangladesh, Vietnam and other countries; Linen fabrics are mainly exported to Southeast Asia, mainly Bangladesh, where they are further processed before being sold to the global market.

2. Ramie textile export

In 2024, China's ramie yarn export will be 282 tons, basically the same as that in 2023; The export of ramie fabric is 11.89 million meters, down 34.41% from 2023. Although the export volume of ramie fabrics has declined significantly, the domestic sales of ramie fabrics will be very tight in 2024, and the supply will fall short of demand. See Figure 13 and Figure 14

Figure 13 Statistics of China's Ramie Yarn Export from 2015 to 2024 (kg)

Source: China Customs

Figure 14 Statistics of China's Ramie Fabric Exports from 2015 to 2024 (m)

Source: China Customs

In 2024, China's ramie fabrics will be mainly exported to South Korea, the Netherlands, Brazil, Turkey, Spain, India, Togo, Japan, Indonesia and Germany.

3. Export of hemp textiles

In 2024, affected by the shortage of flax raw materials, the market of hemp fiber will fall short of demand, and some fibers will mainly replace flax. In 2024, China's hemp yarn export will be 499 tons, a year-on-year decrease of 20.89%; The export of hemp fabric was 3.19 million meters, up 25.80% year on year. See Figure 15 and Figure 16

Figure 15 Statistics of China's hemp yarn export from 2015 to 2024 (kg)

Source: China Customs

Figure 16 Statistics of China's hemp fabric exports from 2015 to 2024 (m)

Source: China Customs

In 2024, China's hemp fabrics will be mainly exported to Cambodia, Germany, Vietnam, Japan, Sri Lanka, South Africa, South Korea, Indonesia, Bangladesh, Spain, India, Canada, the United States, the Netherlands and Nicaragua.

4. Jute textile exports

Jute yarn export has been on the rise in recent years. In 2024, the export of jute yarn will reach 3264 tons, an increase of 36.72% over 2023; The export of jute fabric is 11.71 million meters, slightly lower than that in 2023. See Figure 17 and Figure 18

Figure 17 Statistics of China's Jute Yarn Export from 2015 to 2024 (kg)

Source: China Customs

Figure 18 Statistics of China's jute fabric exports from 2015 to 2024 (m)

Source: China Customs

From the perspective of jute yarn and jute fabric export countries, they are mainly concentrated in developed countries such as Europe and the United States and Southeast Asia. The developed countries in Europe and the United States have a strong awareness of environmental protection. The Southeast Asia region is mainly affected by the climate. Jute products are more suitable for the local climate.

In 2024, China's jute yarn will be mainly exported to the United States, Germany, the Netherlands, France, Japan, Poland, Russia, Indonesia, the United Kingdom, South Korea, Canada, Spain, Australia, Italy and Malaysia; China's jute fabrics are mainly exported to Indonesia, Saudi Arabia, the United Kingdom, Germany, the United States, France, Vietnam, Spain, the Netherlands, Cuba, Poland and Australia.

5. Export of hemp products

In the export of hemp textile products in China, linen bedding, linen tableware, toilet and kitchen articles and linen decorative articles are the main export linen products. In 2024, the export value of China's linen products will be US $694 million, an increase of 36.4% over 2023, of which the export of linen bedding will be US $204 million, an increase of 18.4% over 2023, and the export of linen tableware, toilet and kitchen supplies will be US $115 million, a significant increase of 117.8% over 2023. More and more consumers choose hemp products with the understanding of their comfort, health, green and other excellent characteristics. See Figure 19, Figure 20 and Figure 21

Figure 19 Statistics of export amount of major hemp products in China from 2020 to 2024

Source: China Customs

Figure 20 Country/region statistics of export amount of China's linen bedding in 2024

Source: China Customs

Figure 21 Country/region statistics of export amount of linen tableware, kitchen and toilet articles in China in 2024

Source: China Customs

To sum up, it can be seen that the export of terminal flax products is mostly from countries and regions with high income levels, while flax yarn and fabric, as intermediate products, are mostly exported to countries and regions with strong downstream processing capacity of flax textile industry. This is in line with the industrial development law of the hemp textile industry as a consumer goods and livelihood industry for global resource allocation.

3、 Prospect of linen textile industry in 2025

2025 is the end of the 14th Five Year Plan and the key year for planning the development of the 15th Five Year Plan. The hemp textile industry is still facing the adverse impact of the external environment and the difficult challenges in the process of internal reform and development, industrial transformation and upgrading, but there are also more active and promising macro policies, proactive fiscal policies and moderately loose monetary policies, and good policy mix in 2025, And put the expansion of domestic demand in an all-round way at the top of the year's key tasks and other development opportunities brought by the "policy dividend". In particular, the forum for private enterprises held at the beginning of 2025 has brought confidence and pointed out the development direction to the hemp textile industry enterprises, which are dominated by private enterprises.

Although the international political situation is changing, there will be some uncertain factors, but the hemp textile industry is unique and the market demand continues to rise. We need to take advantage of the potential market advantages of the domestic large-scale and all-round expansion of domestic demand policy guidance, give full play to the terminal products of hemp textile to cover the daily life of the people, and bring green health genes, which can better meet people's needs for comfort, green The unique advantages of fashion, health and other consumer demands for a better life will expand the market share of domestic demand.

The hemp textile industry has experienced substantial fluctuations in raw material prices in 2023 and 2024. At present, the raw material prices have basically recovered to a relatively normal level, and the wait-and-see atmosphere has disappeared. We expect that the hemp textile market will grow significantly in 2025.

(Source: China Hemp Textile Industry Association)

- Related reading

Affected By The Global Economy, The Trading Situation In The Textile Downstream Market Is Still Weak

|

High Domestic Cotton Stocks: Challenges And Opportunities From A Global Perspective

|- Reporter front line | The Agenda Of SIUF Forum Is The First To See: Unlock New Opportunities For E-Commerce! Underwear E-Commerce Industry Ecological Development Forum Invites You To Participate

- Reporter front line | SIUF全球釋放:20周年核心買家團高能集結,豪華陣容搶先揭曉!

- Instant news | 361 ° BIG3 6.0 Has Evolved Again And Has Become The IP Image Of Practical Shoes Recognized By Professional And Street Players

- neust fashion | Bienlefen: A National Clothing Brand Is Quietly Changing

- quotations analysis | Market Analysis: Internal And External Cotton Has Not Yet Broken Away From The Low Position, Lack Of Upward Drive

- Today's quotation | Market Observation: Cotton Mills Have Low Willingness To Purchase Cotton From Real Estate, And Prices Are Generally Depressed

- Market topics | Data Analysis Of Cotton Futures In National Cotton Market Monitoring System

- Visual gluttonous | Green And Environmental Protection: Quantitative Analysis Of Carbon Footprint Of Cotton Textiles

- Reporter front line | Notice Of ITCPE Textile Expo: 2025 Guangdong Hong Kong Macao Greater Bay Area Cultural T-Shirt Competition

- Daily headlines | IP Strategy Of Textile And Clothing Industry: From Symbol Competition To Competition For Cultural Assets

- Popular Colors: 216 Oriental National Colors Are Revitalized By Applying Traditional Chinese Colors To The Intangible Cultural Heritage Of Color Cards

- Xinjiang Scientific Research Team Solved The Technical Bottleneck In The Production And Processing Of Machine Picked Long Staple Cotton

- Industrial Cluster: Tacheng Region In Xinjiang Accelerates The Transformation And Upgrading Of Textile Industry

- SIUF深圳內衣聯動抖音,攜手行業超頭部品牌,引領消費新潮流

- The Agenda Of SIUF Forum Is The First To See: Unlock New Opportunities For E-Commerce! Underwear E-Commerce Industry Ecological Development Forum Invites You To Participate

- SIUF Global Release: The 20Th Anniversary Core Buyer Group Gathered Energetically, And The Luxury Lineup Was Announced First!

- 361 ° BIG3 6.0 Has Evolved Again And Has Become The IP Image Of Practical Shoes Recognized By Professional And Street Players

- Bienlefen: A National Clothing Brand Is Quietly Changing

- Market Analysis: Internal And External Cotton Has Not Yet Broken Away From The Low Position, Lack Of Upward Drive

- Market Observation: Cotton Mills Have Low Willingness To Purchase Cotton From Real Estate, And Prices Are Generally Depressed