When People Have Not Yet Figuring Out What Is New Retail, They Have Reached The White Hot Situation. The New Retail Strategy Of Ali, Jingdong And Tencent Is Analyzed.

Analysis of new retail strategy of Ali, Jingdong and Tencent

Source: This article is reproduced from the public address number BusinessAnalysis (ID:Business-Analysis).

New retail: that is, enterprises rely on the Internet to upgrade and pform the production, circulation and sales process of commodities through advanced technologies such as big data and artificial intelligence, and then reshape the format structure and ecosystem.

The combination of online and offline logistics will lead to new retail sales.

In October 2016, Ali cloud habitat conference, Alibaba Ma Yun in his speech for the first time put forward the new retail, "the next ten years, twenty years, no e-commerce, this is only new retail."

Next, follow the notebook to see a new retail series report: the duopoly leading the next generation of retail revolution, Ali and Jing Teng's new retail strategy analysis.

Main points of report

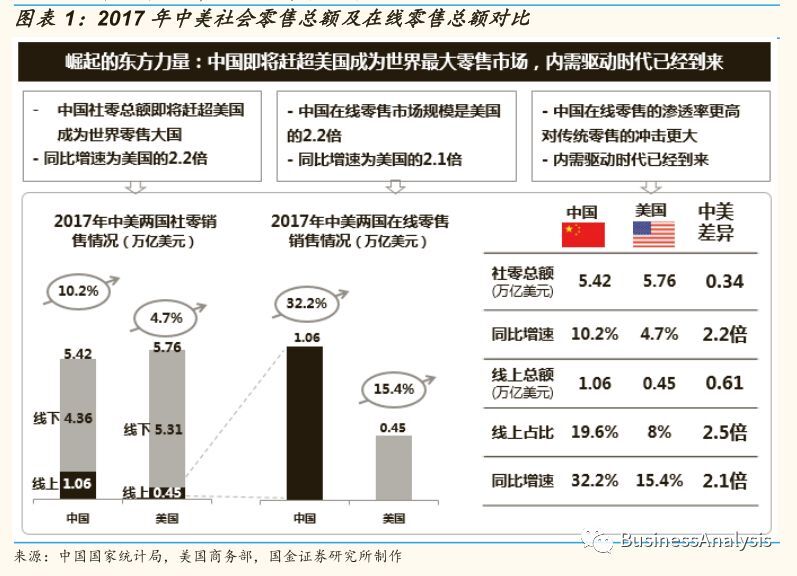

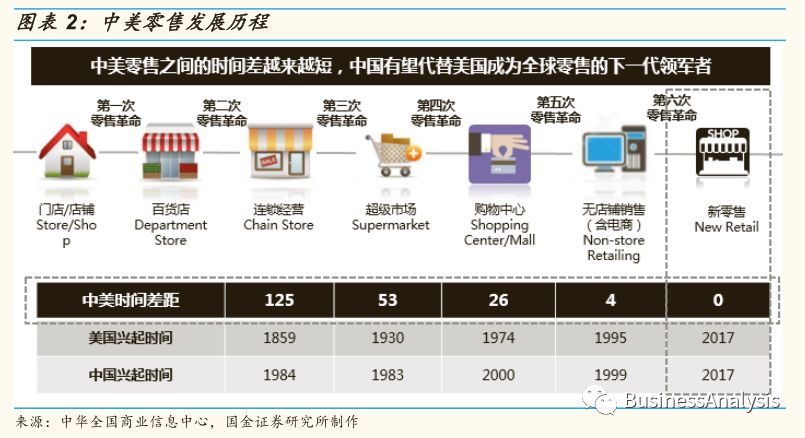

Entering the 2017, China's total retail sales will soon catch up with the United States, and retail sales will become the second industry that can compete with the world's giants after TMT.

The Internet giants represented by Alibaba and Jingdong / Tencent are promoting the overall upgrading of retail and related formats, and fierce competition in the new retail sector, thus driving the optimization and upgrading of the whole society as a whole.

The core of Internet thinking is traffic and efficiency. Therefore, investment and acquisition is undoubtedly one of the effective means of occupying positions in the new retail competition.

The two giant's new retail investment strategy focuses on two main lines:

1. in the stock space, around the clothing, daily, fresh, catering, home five trillions of market competition.

There are three strategic implications.

1. Ensure sustained and rapid growth of core businesses;

The deep meaning lies in the realization of the coverage of big data in the whole field.

Third, to achieve the strategic goal of becoming a social basic data and technology provider.

2. in the incremental space, we should advance the three growth poles of rural electric providers, international electricity suppliers and offline channels ahead of time, and seek greater room for growth.

The core intentions include:

(1) opening up more room for growth;

Second, compete for the leading position of world retailing.

Core conclusion

Strategic logic: from the perspective of appearance, the investment of giants is centered around business and improving ecology, essentially in data layout.

We believe that the size of the business is the key to deciding the outcome of the first half of the new retail season, and big data is the key to winning and losing in the second half.

Market space: according to our estimation of the scale of the industry, the new retail industry still has 4 (offline) +9 (rural) +N (Overseas) times the market increment space.

Industry structure: from the perspective of ecosystem management and control mode, we believe that Ali will still maintain absolute competitive advantage in the next 3-5 years.

First, China's retail industry is catching up with the US.

The new retail giant will lead the whole progress of Chinese society.

1. the total retail sales of China will soon catch up with the US, and the domestic demand driven era will come.

2. retail or will become the second leading industry in the world after the Internet.

3. new retail led by duopoly will drive China's entire industry to optimize and upgrade.

4. line enterprises are the first beneficiaries, big data and AI companies are the ultimate beneficiaries.

Two, the investment logic of the new retail giant:

Offensive and defensive operations around the stock space

Battle for incremental space

In the past online retail competition, Jingdong is lagging behind in terms of traffic, marketing and business scale. Therefore, in the first year of new retail development, especially under the condition of limited line resources, the competition between Ali and Jingdong / Tencent system is more intense.

In order to achieve more efficient coverage of offline resources, Ali and Jing Teng both choose to invest in mergers and acquisitions to accelerate the implementation of this strategy.

1. the two giants: Ali brigade and Beijing Teng team.

Alibaba Ali: since Ali proposed to enter the new retail business in October 2016, he has jointly established new Hangzhou Hanwang new equity partnership with new Hualian holdings, Yunfeng investment, mangrove venture, livelihood capital and Yuhang Industrial Fund.

Not only will he buy shares in Sanjiang, but also work with Bailian together to become the two shareholder of Lianhua, and will combine with modern logistics to create a new retail ecosystem.

(2) Beijing Teng team: marked by investment Yonghui supermarket, in December 2017, Jingdong formally introduced Tencent into the new retail war to fight against Ali's new retail business, and to seize the right and obligation relationship between the parties of the contract, such as delivery of goods, labor delivery, project delivery, etc.

2. investment logic of the two giants

The scope of the two giant horse racing circles extends rapidly from business to clothing, catering, home and many other categories.

From a strategic perspective, we believe that both Ali and Jing Teng's investment logic revolve around the two main lines:

In the stock space, around the existing business offensive and defensive warfare, the industry structure will be rewritten: there are three strategic implications for the five trillions of markets around the clothing, daily, fresh, catering and home markets.

1. Ensure sustained and rapid growth of core businesses;

The deep meaning lies in the realization of the coverage of big data in the whole people and the whole field.

Third, to achieve the strategic goal of becoming a social basic data and technology provider.

In the incremental space, expand the growth of the snatch war, compete for the world leader position: ahead of the layout of rural electricity providers, international electricity providers and offline retail growth of three poles.

The core meaning is embodied in two aspects:

(1) opening up more room for growth;

Second, compete for the leading position of world retailing.

Two, stock space: around five trillions of markets.

1. why are these areas?

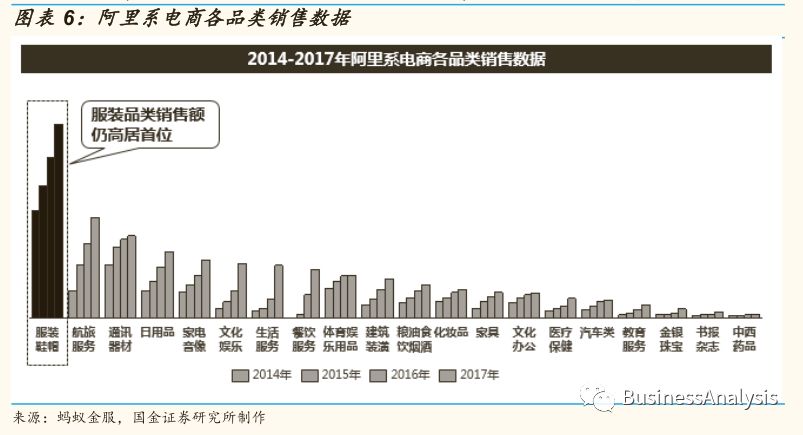

2. clothing: an important business that determines the market position of Tmall and Jingdong.

Clothing is the core of Tmall: in the well-known e-commerce platform, more than half of the electronic business platform will dress as the core business.

As the starting business of Tmall, costumes are responsible for both drainage and sales volume in every big promotion.

Apparel sales accounted for 16.4% of the total sales in 2017, which is still the biggest source of profit for Tmall platform.

With the growth of most sub sectors slowing down, the growth momentum of clothing business is still strong, so it is bound to be an important position for hundreds of competing companies. It is also the first category of Tmall's key defense.

Dress is an important starting point for Jingdong to catch up with Tmall: in contrast, Jingdong's composite growth rate has exceeded 100% in the 5 consecutive years from 2011 to 2016 since the apparel business was launched in 2011. In 2016, new clothes purchased by Jingdong users accounted for more than 40% of the items.

The independent fashion department established in 2017 not only gave the most tilted traffic, but also gave full support in terms of strategy, layout and brand.

(1) Jingdong actively launched the internationalization oriented and personalized fashion layout, launched the designer channel and launched the "Beijing system" strategy.

(2) Jingdong apparel launches in the international fashion week. It launches customized channels in London, a global custom sanctuary. It covers customized services of "clothing customization" and "personalized customization". It has attracted numerous international and domestic brands including Lacoste, Converse, Ray-Ban, Guess, CalvinKlein, Under Armour, etc.

Third, vigorously promote cooperation with designers at home and abroad. At present, Jingdong has worked with hundreds of designers to promote customized business.

In 2017, 618 data showed that the number of female users in Jingdong reached 2 times in the same period last year, and clothing was the largest category to stimulate women's demand for purchase.

Apparel business has become the fastest growing Jingdong, the core competitiveness of the strongest pulling capability. Jingdong is the target of becoming the first category of Jingdong in 5 years. Jingdong CEO officially announced that it will catch up with Tmall costumes at all costs at all costs.

Ali's killing resulted in a stalemate in Jingdong's clothing business. However, after the 618 electricity supplier's big promotion in 2017, the seven flagship stores, such as the grid, the rip and silk, the Korean clothing house, the Jiangnan Buyi, the Taiping bird and JEANSWEST, had disappeared from the Jingdong platform.

And the official flagship store of Hai Lan's family has only a few men's shoes left.

In a month, more than 40 clothing brands have been withdrawn from the Jingdong, most of which are "strategic adjustment" or "business adjustment".

Liu Qiangdong made clear in the three quarter of 2017 analyst conference that more than 100 local brands in China had been forced to withdraw from Jingdong. International brands did not show such a situation, and the growth of GMV as a whole was almost stagnant.

Jing Teng jointly invested in building WeChat electric business circle to fight against Ali:

A. currently has nearly 9.8 billion users of WeChat. Although WeChat has opened access to Jingdong, WeChat traffic has not solved the plight of Jingdong platform growth.

(1) the excessive inlet of WeChat leads to low conversion rate.

2. The number of female users in Jingdong still needs to be improved.

3. Clothing supply chain;

The exemplary role of benchmarking.

To break through the above four bottlenecks and more effectively fight against Ali, Jing Teng has adopted a series of combined initiatives to jointly build WeChat electric business ecosystem:

(1) strategic stake in vip.com;

(2) establishing a joint venture with the beautiful united group.

Third, strategic stake in Hai Lan's home.

B. strategic stake in vip.com: Jingdong to solve the problem of missing female users and clothing category growth.

Tencent open WeChat entrance to solve the plight of vip.com traffic growth is weak, Jingdong and vip.com will realize at member level, commodity, logistics three levels of sharing, gather three party advantage, pull vip.com and Jingdong business double growth.

C. and beautiful union group set up a joint venture: to solve the problem of traffic operation, and jointly build WeChat Taobao.

WeChat traffic scale is large, but it is all social traffic. The conversion rate at the e-commerce level is relatively low. Although it has been explored for many years in Jingdong, it still can not compare with ALI traffic.

The joint venture company established by Jingdong and beautiful Union Group Co operates WeChat traffic, using WeChat's small program and other continuous opening capabilities to extend Jingdong's service capabilities in the supply chain, logistics, big data and other retail infrastructure, fully explore and create the scene and mode of social e-commerce, and build WeChat end Taobao - micro election.

D. strategy shares in Hai Lan's home.

Hai Lan's home is the first fashion group in China's clothing market capitalization. At present, its total market value reaches 51 billion 360 million, and its business involves men's wear, women's wear, children's wear and so on.

As the boss of the clothing industry, Hai Lan's home will undoubtedly provide an example for the subsequent team members and play an important strategic role in revitalizing the business resources.

E. by WeChat, beautiful union group, Jingdong, vip.com together constitute a WeChat business ecosystem has formed.

The first benchmarking businessman Hai Lan's home has also been completed. In order to let other businesses see the power and potential of WeChat's electricity supplier ecosystem, there will be more influential clothing, shoes and hats and textile leading companies as the cooperation target.

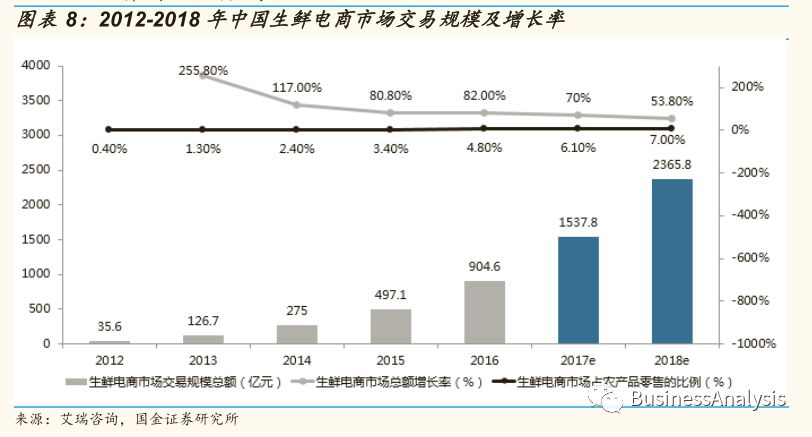

3. fresh: the trillions of blue ocean to be reclaimed, the key to reversing the pattern.

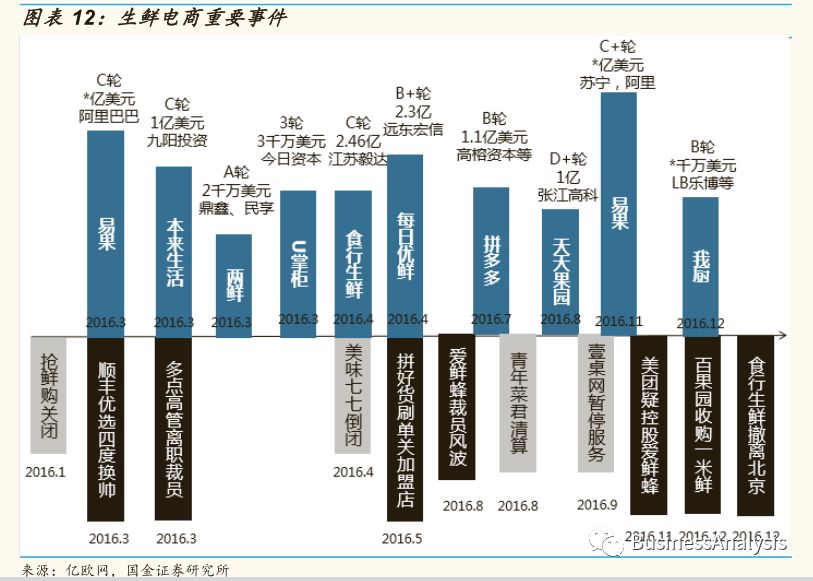

According to AI data, in 2016, the total paction volume of domestic fresh electricity suppliers was about 90 billion yuan, an increase of 80% over 500 billion yuan in 2015, and the total market size in 2017 is expected to reach 150 billion yuan.

Although online penetration is less than 3%, it is growing at a rate of more than 50% per year, which is a new blue ocean for the industry.

High frequency, high customer value and high added value of fresh products are important for offline and online businesses.

The standardization of fresh food is low, the shelf life is short, the consumption frequency is high, the logistics cost is high, and the commodity loss is high. These characteristics lead to the majority of consumers prefer to buy under the line.

Fresh products have a customer like effect, and 60% of consumers say they will cross purchase other products when buying fresh products.

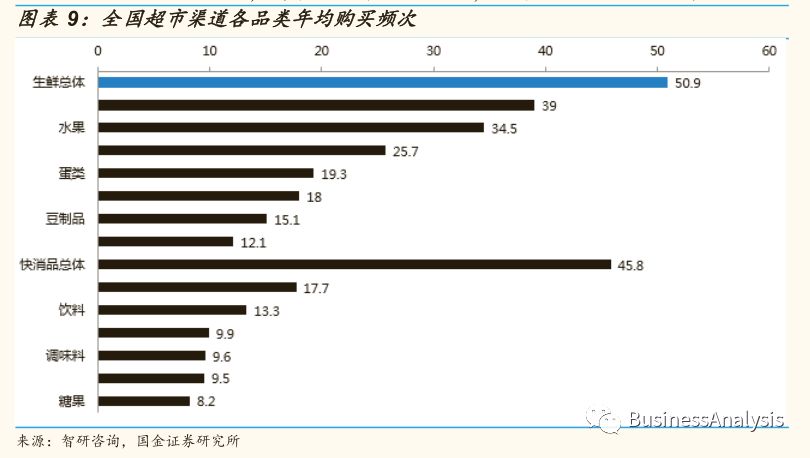

The research data released by Chi Yan research show that in the annual purchase frequency of all kinds of supermarket channels, the frequency of fresh purchase reaches 50.9 times, basically reaching the weekly purchase frequency, which is higher than the 17.7 times of drinks, 9.6 times of condiments and 8.2 times of sweets.

For online businesses, the fresh market is more important:

(1) the fresh market is a huge potential blue ocean market on line, which is important in driving business growth.

(2) in the long run, the data of fresh commodities are more gold than the data of ordinary commodities.

Compared to ordinary businesses, big data is the core asset of future electric business enterprises.

Because fresh commodities are naturally driven by ordinary commodities, fresh produce data are more gold content than ordinary goods.

In order to fight for the right to speak in the blue ocean market and fresh market, many online and offline giants have entered the field of fresh food.

Ali and Jing Teng's fresh War: equal strength, double strong contend for hegemony

Ali Department (ALI group, investment, holding and shares of fresh electricity list) Tmall fresh supermarket, meow fresh life, easy to eat fresh, Amoy sweet, Su Xiansheng, box horse fresh, big fat hair, Auchan, Fei Niu net, Futian network, fast flying cattle, big Ru fat fresh.

Tencent Department (Tencent's investment, holding and share fresh business directory) Jingdong, daily orchard, daily excellent, many, Yong Hui, super species, 7-Fresh, micro shop.

Throughout the Department of Ali:

Tmall fresh: positioning the public daily fresh food market, the price is moderate, mainly in the small packaging, pay attention to the convenience and efficiency of shopping; meow fresh Sheng mainly hit fresh and exploded money, positioning the high-end market, highlighting the quality, mainly imported fresh; while the Amoy sweet is the main source of domestic direct supply of high quality agricultural products, serving many small and medium-sized farmers in the country.

These three sectors cover the most mature mode of the fresh electricity supplier market, and are also sitting on the largest market in the market.

After accepting investment from Ali, Yi Guo undertakes the operation of Tmall's fresh supermarket, and at the same time, Yi Xin Da enhances Ali's strength in fresh logistics.

The box is fresh: as of now, the box horse has opened 35 stores in 9 cities such as Shanghai, Beijing, Hangzhou, Shenzhen and so on, and 3 kilometers near the store can reach 30 minutes.

The pace of opening stores in 2018 will continue to accelerate. The box has reached strategic cooperation with Xincheng holdings, and will provide its stores with resources. The new commercial real estate brand "Yueyue" has realized the layout of 54 cities and 67 commercial projects, including Jiangsu, Sichuan, Fujian, Shaanxi and many other two or three line cities, which will help box Ma complete the layout of two or three line cities.

Focusing on Beijing Teng: Jingdong is naturally the main force to catch up with ALI.

As Jingdong's fresh business started relatively late, Jingdong took advantage of Jingdong's fresh and Jingdong +7Fresh online and offline three ways to catch up with ALI.

Jingdong fresh: positioning high-end high-end population, choose the world's best quality products, the most well-known and largest source of products, from the cultivation to the sale of the entire industry chain coverage of high-quality suppliers to cooperate directly from the origin.

At present, Jingdong has signed strategic cooperation with embassies in more than ten countries around the world to find the best quality products through embassies.

The Jingdong arrived at home: cooperation with the nearly 4000 stores of the international convenience store giants such as the whole family, 7-11, Rosen and so on, to expand the fresh market.

7Fresh: Jingdong is also a sharp weapon in the short battle with the box horse, and it is also one of the largest potential stocks of unbounded retail.

Our research shows that 7Fresh Yizhuang has achieved more than 5 times of the traditional supermarket. In January 2018, the number of pactions reached over 800 thousand, and the daily average traffic volume reached more than ten thousand passengers.

Every day, many of them are excellent and fresh: in recent years, the fresh electricity supplier that has been popular has attracted new investment from Tencent.

The characteristics of the daily fresh and fresh mode are: the total warehouse + the front warehouse, the selected SKU and the small size package.

The characteristic of many modes is social networking.

Two in 2015, the electricity supplier who entered the market has been able to rise rapidly. In addition to the innovation of its mode, there is also a very important point from WeChat's social traffic.

Other giants are also unwilling to lag behind:

Under the mode of offline supermarket + American group take away +APP, it provides delivery service to us by the US group takeaway, and delivers 30 minutes to home service. The main commodity category includes beverage beverage, leisure snacks, dairy products, food baking, instant food, colorful fruits and so on.

Original life: in the field experience innovation, all use online + offline fusion, dining + social diversity scene experience.

4. Catering: to be integrated trillion level market, reversing the two key categories of the market

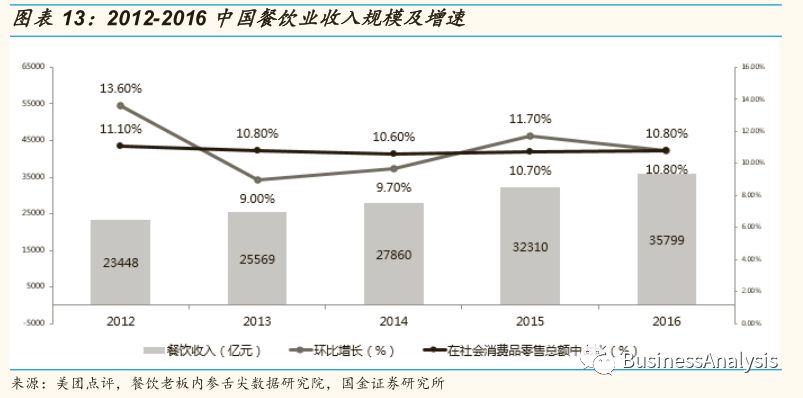

The trillions of food and beverage markets have become the focus of capital chasing: according to the "2017 China food and beverage report" jointly released by the US delegation and the restaurant's owner's tongue Data Research Institute, the Chinese catering industry began to pform in 2012. The scale of the Chinese catering market has reached 3 trillion in 2015, and the breakthrough of 3 trillion and 500 billion in 2016. 2017 is expected to break through 4 trillion and 2020 is expected to reach 5 trillion yuan.

With the entry of mobile Internet, the order of O2O takeaway market is even more popular, and the number of users is over 2 billion.

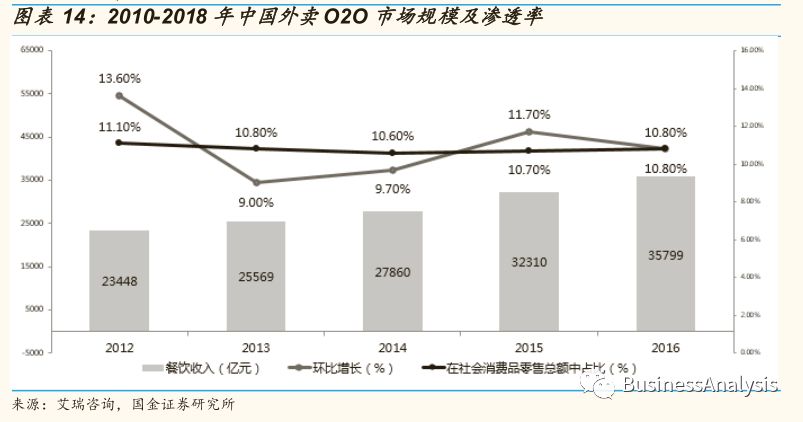

According to AI data, the scale of the Chinese takeaway O2O market in 2017 will exceed 100 billion yuan and maintain the average growth rate of 40%-50% market.

In the face of such a huge potential market, capital is also competing for competition.

Especially in recent years, many new catering enterprises have been favored by capital. "Catering + capital" will become a new trend of industry development in the future.

The online takeaway industry has become the "AT war", and the layout of Jingdong catering is fragmentary: from the previous "three pillars" to today's "AT war" by the outside world, the Internet takeaway industry has only used three years to draw the industry's "Chu Han boundary": in 2015, Ali invested 1 billion 250 million in the hungry market, accounting for about 27.7% of the shares, becoming the largest shareholder of starving.

In the same year, the merger of the US group and the public comment resulted in the formation of a new Tencent in the Internet takeaway industry, the hunger of the new American, the Alibaba and the Baidu background Baidu takeaway.

By 2016, Ali formally agreed to sell the US group's public comment stock rights, and starved formally to establish a competitive relationship with the new US.

In August 2016, Ali invested $1 billion 250 million in joint investment with ants and gold suits.

In April 2017, Ali joined the Ant King suit again to invest $400 million in hunger.

By August, Ali reinvested 1 billion dollars to help hungry buy Baidu takeaway, and now it is hungry to buy wholly-owned Alibaba. After a series of capital operations over the past three years, the Chinese line takeaway industry has officially entered the new stage of "AT war" between Ali and Tencent.

Ali's overall acquisition of hunger will bring a 100 billion level paction volume to Ali ecology, whether it is in the industry layout or from the online takeaway market itself, which will be a good deal for Ali.

5. daily necessities: the core category of online and offline integration

Online has become the main force to promote the growth of fast moving consumer goods: there are trillions of market scale for online supermarkets to be reclaimed. With the entry of No. 1, Tmall and Jingdong supermarkets, consumers' habits of online shopping for general merchandise have been developed.

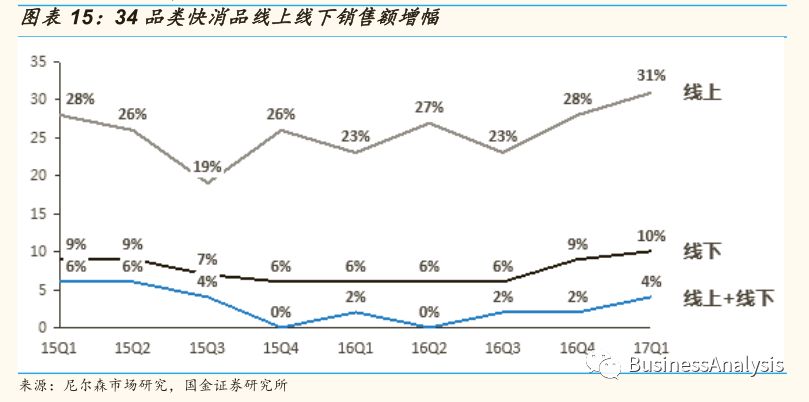

Nelson data show that in the first quarter of 2017, the online sales of 34 kinds of fast moving products increased by 23% over the same period last year, and became the main force to drive the growth of fast moving products.

Jingdong supermarket has become the first line of online and offline, Tmall supermarket temporarily left a city: Ali and Jingdong in the business super field battle continues, so far has not stopped.

As the main force of Jingdong online supermarket, shop No. 1 takes the East China region of Tmall headquarters as a breakthrough point, and launches large-scale and multi band promotion strategy:

(1) invest 1 billion 500 million subsidy users;

Second, monitor Tmall price by 7 x 24 hours to ensure that the price is at least 10% less.

SKU is 30% more than cats.

4. There are series of measures such as free shipping and customer experience without discount.

Tmall supermarket has launched 618 large-scale promotions, such as promotion, discount days, red envelopes and other promotional tools. However, due to the lack of links in mode, pricing, distribution and after sales, the result is not good.

Subsequently, Jingdong announced that the sales growth of Jingdong supermarkets exceeded two times the growth rate of the industry, and sales and sales growth have become the first channel under the domestic online and offline channels. Tmall supermarket has been temporarily losing a battle in online competition.

Box ma let Ali see business opportunities under the line, Tmall supermarket to seek a breakthrough under the line: online and offline integration is becoming a new trend.

First, integrate online ordering and offline consumption into one.

(2) by installing APP, the flow under the line will be attracted to the line.

Through Alipay, it is beneficial to collect all consumption data.

Tmall shifted the focus of the supermarket to offline: at the end of 2016, Ali invested 2 billion 150 million yuan in Sanjiang shopping; 2017 invested in Lianhua supermarket, Xinhua capital, and 22 billion 400 million Hong Kong dollars (about 19 billion 20 million yuan), directly and indirectly holding 36.16% of Gao Xin's retail sales, plus 20 more boxes of fresh horses, and the new retail landing speed was swift and violent.

For strategic defense, Beijing Teng online investment is also unwilling to lag behind, Yonghui supermarket, Carrefour, BBK, in 2018, just over two months, has invested tens of billions of shares, the real estate business has accelerated significantly.

6. home: building the long tail area of home shopping scene

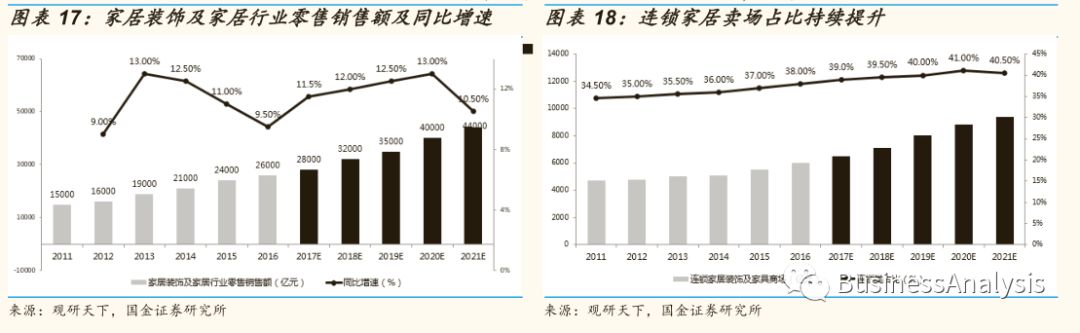

The home retail market has steadily increased, and the proportion of chain stores has been increasing: the scale of home decoration and furniture industry has maintained steady growth. In 2006, the scale of the industry was nearly 1 trillion and 230 billion yuan. After 11 years of development, the industry sales volume reached 3 trillion and 980 billion yuan by the end of 2016, and the compound growth rate of the 2006-2016 year industry was 12.44%.

Benefiting from the steady development of the national economy and the driving effect of consumption upgrading on industry consumption, the retail sales of furniture industry is expected to maintain steady growth. It is estimated that the retail market will reach 4 trillion and 400 billion by 2021, and the proportion of chain stores will continue to increase.

The challenge facing online home is that despite the strong voice of the business tycoons in clothing, home appliances, fast food and other categories, it has been difficult to break through in the home furnishing area. There are two main reasons:

(1) furniture home furnishings are non-standard products and the unit price is high. It is difficult for consumers to place orders with the introduction of pictures and texts on the Internet.

2. After-sale problems such as sending and finishing decoration after the sale of online furniture is an important bottleneck hindering business development.

From Ali's sales data, furniture has grown to second of per capita consumption, and the importance of Ali is self-evident.

In addition, Tmall's 2017 double eleven sales TOP10 brand, in addition to Lin's wood industry for the Amoy self cultivation business, other brands of offline stores are distributed in the hands of the incredibly home and red star, such as the giant line, if you want to achieve online and offline linkage, break through the bottleneck of business bottlenecks will become inevitable.

Online and offline integration has become inevitable: in order to break through the bottleneck of home development, Alibaba's home has helped to upgrade its home stores comprehensively and digitally. Based on the two member system to open up and digitize the products, the scene reconstruction and experience upgrading of consumers in building materials and furniture have been realized, and the rapid integration of online and offline has been realized. At the same time, the two sides will jointly build a cloud decoration platform, from the decoration design, material purchase and construction management to full line reconstruction of online home sales mode.

This will bring a new dawn to the development of the home industry which is lagging behind. The brand furniture, home design, home sales and logistics distribution in the home industry chain will become an important point in the future.

7. conclusion

Business disputes only decide the outcome of the first half: from the above analysis of the double strong contention tournament, Ali and Jing Teng Department in the field of clothing, fresh, home, Department of daily use and other electronic business areas to compete fiercely, after completing the coverage of these five fields, has realized the basic coverage of four aspects of the consumption and consumption of residents' consumption.

On the face of it, this is the ground race of the horse race enclosure, and the big data hidden behind it and the value of AI technology are even greater. This is the key to decide whether the giants will succeed in the second half.

Big data and technology are the key to success or failure in the second half: when traffic growth hits the ceiling and business expansion reaches its limit, competition among giants will shift from horse race to internal force, that is, the level of consumer operation to increase traffic conversion rate.

In the strategic plan of Ali in the next ten years, the core reason for future strategic focus is to regard entertainment as the main reason.

Ali's new retail is a big data driven integration of online and offline, reconstructing people's freight yard, or digitalization of the core elements of the retail industry. It includes five key pformations: customer, product, purchase, payment and loyalty from online to offline, from offline to online.

The concept of new business marketing is being hatched. The Ali system will cover consumers' data in the whole scene and the whole field, including consumers' food, clothing, entertainment, entertainment, education and so on, including the full channel operation of online and offline access. Ultimately, it can realize the entire closed loop from the traditional marketing model from cognition, intention, purchase, purchase and loyalty, and the synergy effect of electric business and entertainment will be stronger and stronger.

Therefore, big data and technology are the key to success or failure in the second half.

Three, incremental market: snatch three growth levels.

Open up 4+9+N times growth space

1. offline retail market: 4 times market increments

Judging from the proportion of total social zero, online retail accounts for only 15%, and 85% of the market share still needs to be reclaimed.

With the deepening of online and offline integration, the share below the line will gradually shift to online, which means there are still more than 4 times the market space to be excavated.

2. rural retail market: 9 times market increments

According to McKinsey's 2016 China digital consumer survey report, consumers in the cities below three cities for the first time surpassed a second tier city.

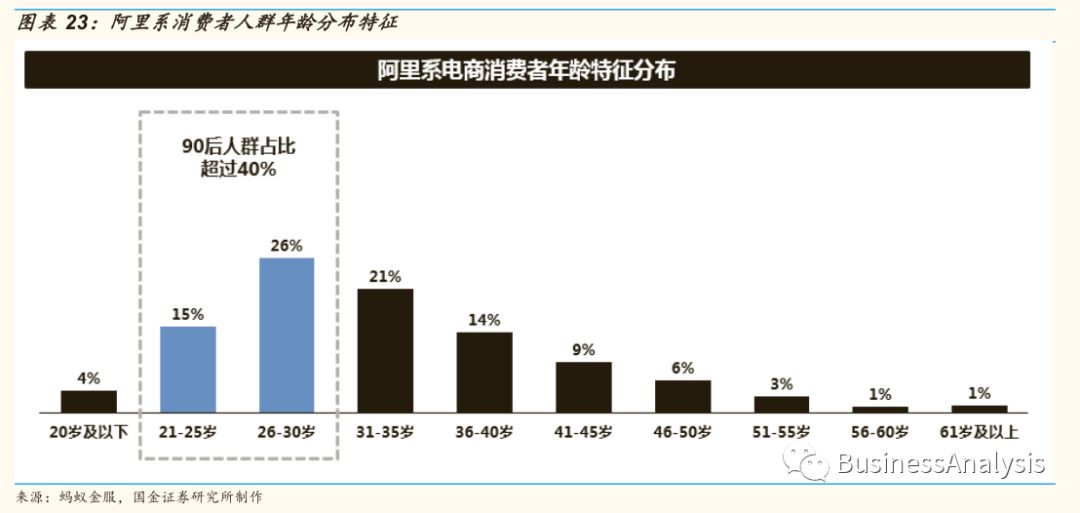

ThinkData2018, 01, 05, released in 2017, "the post-90s Lifestyle Research" found that China's post-90s crowd has a high degree of concentration in the three or four tier cities. The population after 90 is precisely the highest proportion of customers in the Department of electricity, and the crowd accounts for over 40%. The distribution characteristics of the crowd will drive the electricity business of three cities below, especially the vigorous development of the rural e-commerce business.

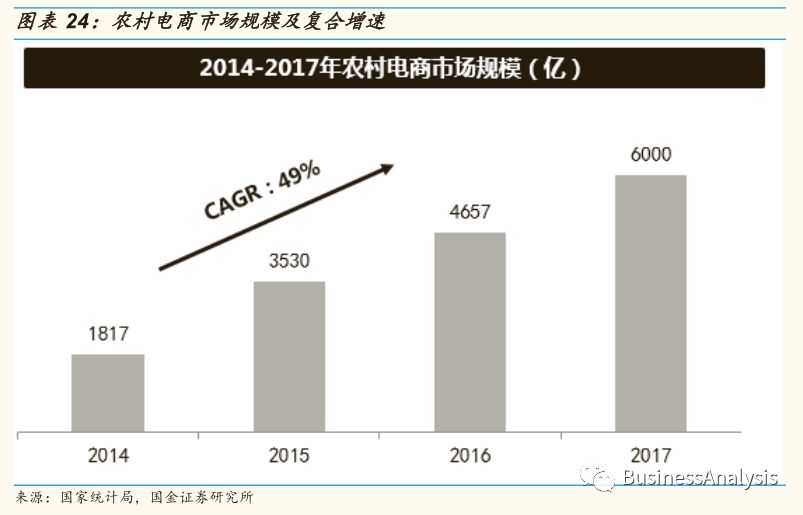

Affected by these factors, the scale of rural online shopping market in China has shown a trend of sustained growth in recent years. In 2015, the scale of the market reached 353 billion yuan, and by 2016, it had risen to 482 billion 300 million yuan, the growth rate reached 36.6%, and in 2017 it was as high as 600 billion.

The expansion of the market scale still can not conceal the low permeability, and the penetration rate of the entire rural electricity business is only 7%. This means that the rural electricity suppliers will have 9 times the market potential, and 700 million of the potential rural users need to be excavated.

Ali rural electric business strategy: Ali announced the launch of the "thousand counties and ten thousand villages" plan, will invest 10 billion yuan in the future, build 1000 County operation centers and 100 thousand village level service stations nationwide, and help rural electric business system construction.

Jingdong rural electric business strategy: the 3F strategy of Jingdong rural electric business, including Factory to Country (Country), rural financial strategy (Finance toCountry) and fresh electricity business strategy (Farm to Table), set up county level service center in more than 600 counties nationwide, and carry out the logistics distribution and shopping experience of rural electric providers.

More than 100 thousand rural cooperation points and promoters are recruited in 100 thousand administrative villages to provide shopping, Internet experience and other services for farmers.

To sum up, Ali and Jingdong's efforts to promote rural electricity providers are not as good as they want. But the new retail retail layout and 2B mode will be integrated from store decoration, commodity distribution, supply chain, storefront relationship, financial support and other aspects, vigorously promoting the pformation and optimization speed of rural small shops and spouses and shops. We believe that the future rural retail network will achieve leapfrog development.

3. international retail market: N times growth space

From the perspective of e-commerce penetration, the penetration rate of developed countries in Europe and the United States is over 80%. China is less than 50%. In addition, the amount of online shopping per capita in major developing countries is higher than that in China. Among them, the US per capita spends 1804 US dollars in the first place. The UK spends 1629 US dollars behind it. China's per capita online shopping consumption is only 626 dollars, ranking the bottom third.

For Chinese e-commerce enterprises, the online shopping market in developed countries such as Europe and the United States has great potential.

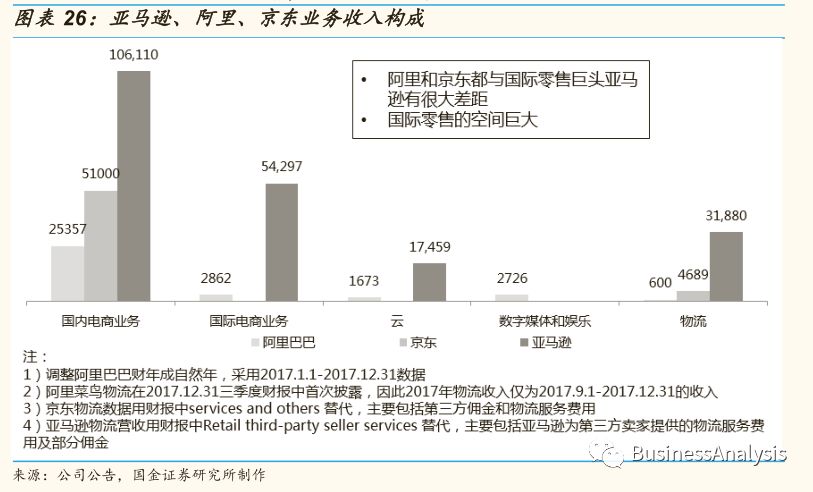

From Amazon's financial data, the international business income of electricity providers has accounted for 34% of Amazon's business income.

Although overseas business is temporarily in a state of loss, Bezos hopes that international business can become a new growth point for Amazon in the future, causing a strong "flywheel effect" inside Amazon.

After losing the Chinese market to Alibaba and Jingdong, Amazon CEO Geoff Jeff (Jeff Bezos) is determined to invest $5 billion 500 million to win the India market.

Although the cake in foreign market is tempting, the short board in infrastructure and market acceptance needs to be made up gradually, so it is still in the investment stage, and the concrete results still need to be revealed.

Ali international layout: Ali has begun to layout international business. In the 2017 fiscal year, the number of overseas active buyers from fast selling and lazada on the Ali platform reached 83 million, which is close to the total population of Australia and the United Kingdom.

Ali global strategy cloth includes the system to enter the international market, the comprehensive layout electricity supplier, cloud computation, entertainment, finance and so on many commercial domains, and promotes the eWTP (Electronic WorldTrade Platform, the electronic world trade platform) in the whole world.

Jingdong's international layout: Jingdong is also lagging behind in its entry into the international market.

After the launch of services in Indonesia in 2015, the international expansion of the Jingdong was at a standstill. Since the Davos conference in 2017, Jingdong seems to have begun to increase its international business.

Liu Qiangdong said Jingdong will continue to invest in overseas markets. The company hopes that overseas revenues will account for half of the total revenue in the next ten years.

In the second half of 2018, Jingdong will take the lead in launching the US expansion plan in Losangeles. In 2019, it launched into Europe, launched e-commerce platforms and delivery services in France, Britain and Germany, and made its business cover Europe for several years. Jingdong should challenge Amazon's global position.

4. conclusion

To sum up, the offline, rural and international markets are the three new growth poles for the business tycoons to strive for sustained high-speed development. Among them, offline retail will contribute at least 4 times the value added space to the giants, and the rural retail will contribute at least 9 times, and the imagination of the international market will be more than N times.

If the exhibition industry is successful, China will have more than 2 world class Big Macs.

From the perspective of progress, compared with the domestic war situation, the giant's layout in the new growth pole is relatively dull.

Under the pressure of friends, the development of Ali's online business has been hindered. The box horse's fresh life has seen Ali's huge potential under the line, and has sought a new way out of the line. This wave of competition has led to the vigorous development of the retail business under the line.

Although the potential of rural retail is huge, due to the problems of small scale, scattered distribution and difficulty in integration, the ranking of the most concerned areas is lagging behind.

The huge space of the international retail market is obvious to all. Not only China, Amazon, WAL-MART and other world retail giants are eyeing this cake, but due to the natural barriers of national policies, cultural differences and infrastructure facilities, the entry threshold of this market is relatively high.

However, the world has never been short of miracles, and we are full of confidence in Chinese retail enterprises.

Four, industry pattern: in the next 3-5 years,

Ali will remain a new retail leader

1. core resources

We will comprehensively evaluate the prospects of Ali and Jing Teng from the aspects of the ecological system, the management and control model and the strength of the core module.

Ecological system: the number of the Jing Teng alliance is large but the whole strength is lost in Ali

(1) ecological composition: the number of allied forces in the Tencent department is large, and the new retail closed loop, which consists of flow source, flow operation, e-commerce platform, e-commerce service (logistics, Finance) and offline, has been completed.

As the ancestor of the ecological system, Ali is a natural pioneer in the layout of e-commerce and new retail.

(II) active users: from the active user data released in December 2017 by the main platforms of both sides, the total number of active users of the 5 largest consortium of Beijing Teng new retail company is 451 million 980 thousand, which is lower than that of Taobao and Tmall combined with 502 million 380 thousand people, which is only slightly higher than the number of active users of Taobao's single platform. This indicates that the flow capacity of the Beijing Teng system, especially the multi platform traffic linkage capability, needs to be improved.

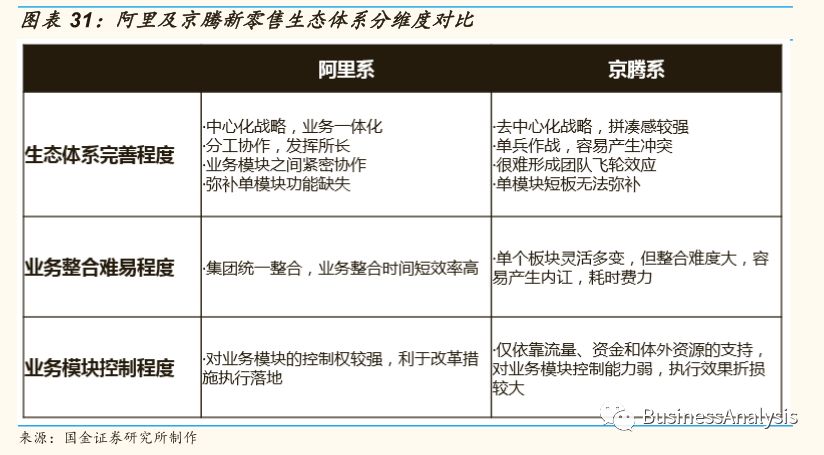

Control mode: Beijing Teng to centralization of control capability is weaker than Ali's central control.

From the point of view of management mode, there are great differences between the Ali department and the Beijing Teng system in terms of the degree of perfection of the ecosystem, the difficulty of business integration, and the degree of control of business modules, as shown in the table below. Three.

Core module strength: the gap between Jingdong's internal strength and Ali is still large.

Jingdong is the main force of the Beijing Teng new retail alliance. Its business level has the greatest influence on the whole ecosystem.

Since Tencent became a shareholder in Jingdong and became the largest shareholder of Jingdong, it has given great support to Jingdong in terms of wealth and property. Its growth in the past three years has entered the fast lane.

After GMV broke through trillion in 2017, it is expected to surpass Tmall in 2021 and compete with ALI on the same platform.

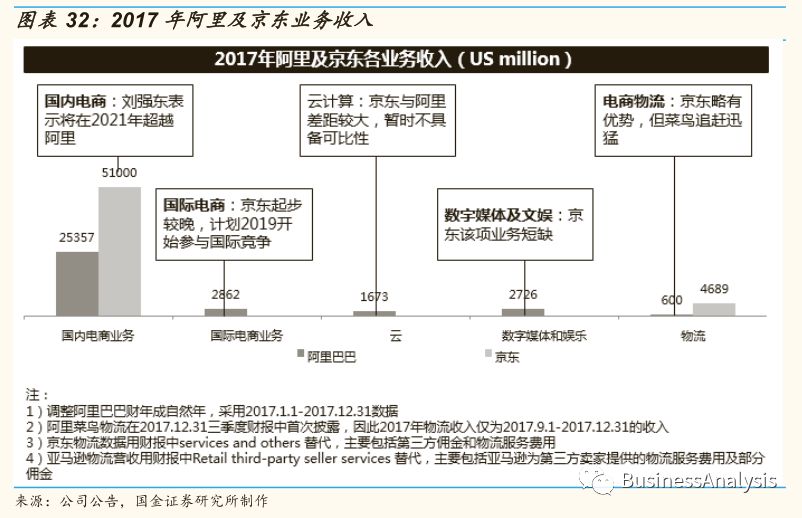

We compare and analyze Jingdong and Ali's 2017 revenue, active users and market share three indicators, although Jingdong grew faster, but there is a big gap between many businesses and Alibaba, and it is difficult to catch up in a short time.

(1) revenue level: apart from a slight advantage in logistics business, there is a big gap in e-commerce business, technology and entertainment.

In addition, the gap in logistics has been shrinking in the rush to catch up with rookies.

Active users: there are still big differences between Jingdong and Alibaba.

In 2017, the number of active users of Jingdong was 293 million, which was equivalent to the mid-level of 2013 in Ali. Considering the continuous expansion of Jingdong's traffic volume, the number of users increased faster than Ali. It would take 2-3 years to achieve the same number of users and Ali.

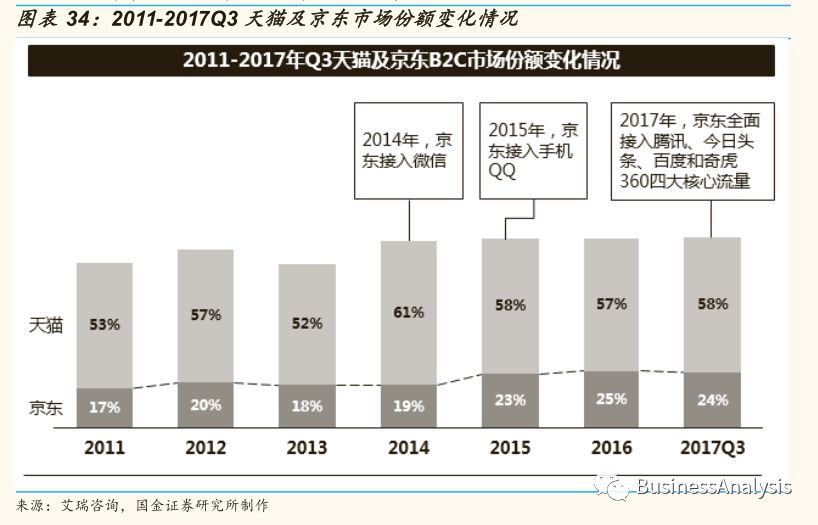

(3) market share: since 2014, WeChat traffic has been imported into Jingdong. However, the impact of WeChat traffic conversion rate and the imperfect internal business of Jingdong has not had a disruptive impact on Tmall's business, reducing Tmall's market share to less than 60%.

In 2015, Jingdong joined the mobile phone QQ, and in 2017, it joined the other three core entries of today's headlines, Baidu and Qihoo 360, but did not have much impact on the B2C market share.

The gap between Jingdong and Alibaba is not only reflected in traffic volume, but also in the comprehensive strength of traffic operation, business capability and internal capability.

2. core team

Ali Brigade:

Chiang fan - is good at innovation: Taobao President / group vice president, founder of venture company, joined Ali, promoted Taobao to data-driven, thousands of faces, and led the team to build Taobao content system.

Jing Jie, who is good at brand Digitalization: Vice President of Tmall President / group, 70, from the traditional brand and retail business, has rich business experience and understanding of customers' pain points. As a team leader of Tmall class, he made clear business decisions and assumed the responsibilities of Tmall organization.

Hou Yi, well versed in the way of Logistics: Vice President of group, founder and CEO of box horse fresh life, formerly Jingdong logistics director.

The Jingdong team:

Wang Xiaosong is good at developing new businesses: responsible for new businesses such as fresh products, consumer goods and new channels.

Joining the Jingdong for ten years, 32 became Jingdong's youngest VP.

During the 6 years, Jingdong mobile sales increased from 30 million yuan to 10 billion yuan.

In 2015, led the 3C division to build up the advantage barrier of Jingdong in the electronic category.

Hu Shengli - good at business innovation: responsible for home, fashion, TOPlife, patting second-hand business.

Leading Jingdong 3C business to set up a leading position in the industry, and leading Jingdong 3C Tourism Division to make outstanding contributions in terms of performance, market influence and innovation.

Yan Xiaobing is good at fighting hard: responsible for +3C+ global business.

He once served as general manager of Gome in Beijing. He was well versed in the way of home appliance sales, and his work style was tough. He led Jingdong's home appliances to take turns in the bombing of Gome, Suning and Ali, and the market share ranked first on the line.

3. armies allied forces

Ali alliance camp: Ma has pulled up the four major allies of Yintai, Suning, Sanjiang and Bailian, and has opened up new retail layout with many entrepreneurs.

The alliance has strong strength, rich experience and abundant funds. It will provide strong support for the development of new business in the future.

Beijing Teng alliance camp: Ma Huateng team Liu Qiangdong, nurturing WTMD (vip.com, today's headlines, the US group take away, drop a taxi), to achieve the immortal throne of Tencent.

- Related reading

Share The Economy, Market Pformation, Business Is Difficult To Do, People Go There? Global Push Family Ties To Promote Tens Of Millions Of Promotional Fees To Help Micro Enterprises Pformation And Development Of Cloud Business Platform Free

|

Look At How The Russian Post-90'S Sell "Exploding" Clothes And Fashionable Taobao.

|

Most People Think They Know What They Are Good At, And More Often Than Not, People Only Know What They Are Not Good At.

|- Professional market | Who Will Dominate The Sports Brand In 2019?

- Enterprise information | Are You Able To Get Out Of The Gloom And Save Yourself?

- financial news | Tmall 2018TOP100 New Product: Coconut AJ Lining Fashion Week Casual Shoes List

- financial news | Messi Quit, Auchan Changed His Mind, And Foreign Retail Sales Were Coming.

- Daily headlines | There Are Frequent Problems In The Foundry.

- Celebrity endorsement | Wei Xiao Two Generation Jordan Signature Boots Officially Released

- Industry dialysis | More Retailers Will Go Bankrupt In 2019.

- Recommended topics | One Hundred Thousand Volt "Meng" Turn You! POOVE Carries IP Popularity.

- Instant news | Alexander Wang Wants To Broaden The Market And Cooperate With Centrino Fashion.

- Popular this season | Net Red Sydney: Ready To Welcome The Advent Of Net Red Era.

- LENZING Is Redefined As A Professional Product Of Lan Jing Group, Which Is More Environmentally Friendly.

- Dream Is The Same.

- French Fashion Underwear Show, The First Model Can Make Me Memorable For Three Days.

- Jimmy Costumes Tell You How We Made Them.

- Sports Cars And Beauties! The Luxury Car Overflows The Earthquake Field, The Beautiful Woman Displays The Hot Body.

- Extreme Temptation, The International Supermodel Surges, Almost Nosebleed.

- Fashion, Full Screen Full Of High Face Long Legs

- Summer Fashion, Fashion Wear, Red Wine Is The Most Attractive.

- Will Animal Fur Come Out Of Fashion And Will The Next Feather Product Be?

- Shanxi'S 3 Spinning, Dyeing And Weaving Processes Are Included In The First Batch Of National Traditional Technology Revitalization Catalogue.