Hengli: This Year, PX Imports Have Been Cut By Nearly Half; Yisheng: PX Profits Have Fallen To Below $250 / Ton. Japan And South Korea Are On Pins And Needles.

In March 2019, Hengli Petrochemical launched a factory with an annual production capacity of 4 million 500 thousand tons PX in Dalian.

In July 2019, Shandong's Hongrun Petrochemical 700 thousand ton / year PX plant began trial operation.

PetroChina will launch a 1 million ton / year PX plant in Hainan in the third quarter.

At the end of 2019, Zhejiang Petrochemical plans to put up a factory with an annual output of 4 million tons PX in Zhoushan.

It is reported that from March 2019 to March 2020, China will add about 10 million tons of capacity, enough to produce 22 trillion 500 milliliters of plastic bottles.

The surge in supply in China has pushed down the selling price of PX. Since then, the price of para xylene (PX) has been falling repeatedly. By now, it has dropped by nearly 2000 US dollars per ton, or 22.22%. It also undermined PX processing margins, or the price of PX relative to naphtha dropped from 600 to 700 dollars a tonne a year ago to below $320 a tonne in mid August.

PX industry chain processing is poor (unit: yuan)

"The profit margin of 600~700 dollars is crazy and unlikely to happen again," said the head of Hengli Group. Hengli Group has cut nearly half its PX imports this year.

"The profit margin of 600~700 dollars is crazy and unlikely to happen again," said the head of Hengli Group. Hengli Group has cut nearly half its PX imports this year.

Zhejiang Yisheng Petrochemical Industries Co predicts that after the operation of Zhoushan petrochemical PX plant in Zhejiang, PX profits may fall to less than US $250 per ton later this year, and even lower in early 2020.

Private enterprises are leading a new wave of PX construction through a series of projects. These projects are often combined with large refineries to make them more cost competitive and flexible.

Current domestic PX capacity data

91% of the domestic PX installations are integrated devices. Naphtha is used as the direct raw material, and the quantity of naphtha purchases is restricted by the state. To a certain extent, the development of PX industry in China is limited.

91% of the domestic PX installations are integrated devices. Naphtha is used as the direct raw material, and the quantity of naphtha purchases is restricted by the state. To a certain extent, the development of PX industry in China is limited.

At present, the total domestic production capacity is 18 million 430 thousand tons, a total of 18 production enterprises, and 16 upstream enterprises, accounting for 90% of the total capacity of the country. There are 8 downstream enterprises, accounting for 55% of the total capacity of the country. There are neither upstream nor downstream enterprises, including two, accounting for 9% of the total capacity.

In 2019, the domestic PX production capacity is expected to reach 10 million 100 thousand tons / year, or will become a turning point in the PX market.

Imports fell for the first time in more than 10 years, and Japan and South Korea faced a dilemma.

As the world's largest consumer of PX, 60% of China's PX demand depends on imports to meet the rapid growth of polyester demand. Since 2010, China's Polyester demand has more than doubled. More than half of China's PX imports come from Korea and Japan, and the new capacity is expected to reduce China's PX imports by about 50%.

As of June 2019, the total import volume of PX was 7 million 897 thousand tons, while the annual import volume was expected to drop to 11 million tons, down 29%. A consultancy estimates that China's PX imports may fall to 7 million tonnes next year, further down to 4 million tons in 2021. This year's imports fell for the first time in more than 10 years, down from a record 16 million tons in 2018.

Without the support of the Chinese market, the profit margins of PX producers such as Japan JXTG holdings, South Korea's Lotte chemical and modern Cosmo Petrochemical Industries Co are expected to decline further, which may lead to a decline in both production and profits.

Japan's JXTG holding company said the deterioration of the PX market caused its first quarter profit to shrink, but the company remained optimistic about the growth of PX demand in Asia, and plans to shift some of its PX exports to the Americas. Yoshiaki Ouchi, senior vice president of JXTG, said earlier this month that the company's quarterly profits fell by 88%: "one of our concerns about the latest performance is the decline in PX profit margins." Due to the decline in PX profit margins, Japan's Nomura holdings lowered its forecast for JXTG's 2021 financial year earnings.

As time goes on, many Asian exporters will substantially reduce the operating level of PX devices, and the possibility of closing or integrating production capacity in areas with low profit margins in refining and aromatics will also increase.

PX exporters in Japan and South Korea will soon face a dilemma: will they continue to compete for a shrinking export market or turn aromatics into a much larger gasoline market?

- Related reading

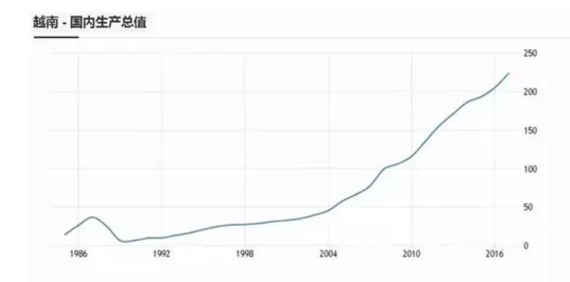

Vietnamese Yarn Is Riding On The Dust, And The EU And Vietnam Have Abolished 99% Tariffs.

|

There Is No Place Like Imitation Memory, But T800 Is Queuing Up For Goods. This Year's Textile Market Is Really Like A Sieve, And A Few Of The Sifting Products Are Outstanding.

|

The Polyester Staple Fiber Is Still Warm, And The Production And Marketing Of The Staple Fiber Is Not Difficult.

|

Talk About The Situation -- The Most Powerful Voice Of Transformation And Upgrading Of Traditional Textile Province

|- Project cooperation | Henan'S 30 Textile And Clothing Items Are Included In The Provincial Key Points.

- Footwear industry dynamics | The First Shoe And Clothing Company Went Public In 2012.

- financial news | Chinese Traditional Culture Is Not The Fetter Of Market Economy.

- Association dynamics | The Focus Of The Textile Industry Continues To Shift.

- Regional investment promotion | Dongguan Europe Children's Clothing 2012 Autumn Order Meeting Will Be Held Soon

- Dress culture | The Clothes Of Ancient Ancestors, The Costumes Of Li Nationality

- 24-hour non-stop broadcasting | Winter Clothes Are Selling Cold Spring Clothes &Nbsp; The Clothing Market Is Ice And Fire.

- financial news | Food Prices Continue To Go Down

- DIY life | Grasp And Maintain The "Key Cycle" And Accomplish The Myth.

- Fashion character | Yuan Li Married &Nbsp In Canada; Kissed In Chinese Dress.

- Vietnamese Yarn Is Riding On The Dust, And The EU And Vietnam Have Abolished 99% Tariffs.

- There Is No Place Like Imitation Memory, But T800 Is Queuing Up For Goods. This Year's Textile Market Is Really Like A Sieve, And A Few Of The Sifting Products Are Outstanding.

- The Polyester Staple Fiber Is Still Warm, And The Production And Marketing Of The Staple Fiber Is Not Difficult.

- Talk About The Situation -- The Most Powerful Voice Of Transformation And Upgrading Of Traditional Textile Province

- The Environment Is Changeable. Nearly 100 Representatives Of Spinning Machinery And Equipment Enterprises Gathered In Guilin To Identify Directions.

- 2019 "Qiu Du Cup" China Fur Clothing Creative Design Competition Preliminary Comment!

- Adidas X Pusha T Joint Ozweego Sand Shoes Shoes For The First Time Exposure

- How Can Bengbu's Textile Industry Shine Again?

- China Will Vigorously Develop Recycled Fiber And Promote Green Manufacturing.

- The Environment Is Changeable. Nearly 100 Representatives Of Spinning Machinery And Equipment Enterprises Gathered In Guilin To Identify Directions.