Thinking About "Sino US Trade Friction" Is The Most Thorough Analysis At Present.

Thinking about "Sino US trade friction" is the most thorough analysis at present.

Source: Bureau Finance 05-23287

"Those who do not seek the world will not seek for a time."

If we do not understand the global situation, let us know about China.

Rise of financial empire

In July 1944, the United States took over the monetary hegemony from the British Empire. President Roosevelt pushed for the establishment of three world systems, one is the political system - the United Nations; the other is the trade system - GATT, that is, the later WTO; one is the monetary and financial system, that is, the Bretton Woods system.

In accordance with the wishes of the Americans, the Bretton Woods system established the hegemony of the US dollar.

But in fact, after 20 years of practice, from 1944 to 1971, 27 years did not really win the hegemony of the Americans.

What blocks the hegemony of the dollar? It is gold.

At the beginning of the establishment of the Bretton Woods system, in order to establish the hegemony of the dollar, the United States once made a commitment to the whole world, that is, the currencies of all countries should be locked in US dollars, while the US dollar should be locked in gold.

How to lock it? 1 US gold for every 35 dollars.

With the promise of the US dollar to the whole world, Americans can not do whatever they want.

To put it simply, a $35 exchange of 1 ounces of gold means that Americans can't overprint the dollar, you print more than $35, and you have to store 1 ounces of gold in your vault.

The reason why the United States has a strong commitment to the world is because it has mastered about 80% of the world's gold reserves.

Americans believe that I have so much gold in hand that it is no problem to use it to support the credit of the US dollar.

But things are not as simple as Americans think.

After the Second World War, the United States was foolishly involved in the Korean War and Vietnam War.

The two wars cost America a lot, especially the Vietnam War.

During the Vietnam War, the United States almost knocked down $eight hundred billion in military spending.

With the war becoming more and more expensive, the United States is not able to afford it.

Because, according to the promise of the United States, the loss of every 35 dollars means the loss of 1 ounces of gold.

By August 1971, Americans had about more than 8800 tons of gold in their hands, when Americans knew it was a bit of trouble, while some people were still making new troubles for Americans.

For example, French President De Gaulle, who did not believe in the US dollar, asked French finance ministers and central bank governors to see how many dollars they had in France. The answer was about 2 billion 200 million to 2 billion 300 million dollars.

De Gaulle said that none of the points should be left to the Americans for gold.

The French attack on the United States had a demonstrative effect on other countries. Some other countries with foreign currency surplus expressed to the Americans that we did not want us dollars or gold.

This forced Americans to have no way to go.

So in August 15, 1971, when President Nixon announced the closing of the golden window, the dollar was decoupled from gold.

This is the beginning of the collapse of the Bretton Woods system and a betrayal of the world by Americans.

But for the whole world, people could not fully understand the clue at that time.

We believe that the US dollar is due to gold behind the dollar. The US dollar has become the international currency, currency and reserve currency for more than 20 years, and people have become accustomed to using the US dollar.

Now the dollar suddenly stops, and there is no gold behind it. In theory, it turns into a pure green paper. Do we still need to use it at this time?

You can not use it, but what is the value of the goods in international settlement?

Because money is a yardstick of value, so if we do not use the dollar, can we trust other currencies? For example, between the RMB and ruble, the Russians (at that time the Soviet Union), if we did not recognize the renminbi, and we did not recognize the rouble, we could only continue to use the US dollar as the medium of exchange between us.

So the Americans used the inertia and helplessness of the world to force OPEC to accept the American conditions in October 1973: global oil pactions must be settled in US dollars.

Before that, global oil pactions could be settled in various international currencies, but everything changed after October 1973. OPEC announced that it had to settle the global oil deal with us dollars.

In this way, Americans are linked to commodity oil after they are decoupled from gold and precious metals.

Why? Because Americans can see clearly that you can't like dollars, but you can't dislike energy. You can't use dollars, but can you not use oil?

Energy consumption is needed for any country to develop. Oil is needed in all countries. In this case, you need oil for us, which is a very smart move for Americans.

Since the beginning of 1973, when the US dollar was linked to oil, the dollar had begun a new course with the United States after the decoupling of US dollar from gold in 1971.

At that time, few people in the world saw this clearly, including many economists and financial experts. They could not very clearly point out that the most important events in twentieth Century were not other wars, nor the disintegration of the Soviet Union, but the most important event in twentieth Century was the decoupling of US dollars from gold in August 15, 1971.

Since then, mankind has truly seen the emergence of a financial empire, which has brought the whole human race into its financial system.

In fact, the establishment of US dollar hegemony began at this moment.

About 40 years ago.

And from this day on, we enter a real paper currency era. There is no precious metal behind the dollar. It is fully supported by the government's credit and profits from the whole world.

Simply put, Americans can get physical wealth from the whole world by printing a green paper.

No such thing has ever happened in human history.

There are many ways to get wealth in the history of mankind, either by exchanging money, or by gold or silver, or by war, but the cost of war is enormous.

When the dollar becomes a green paper, the cost of us profits can be extremely low.

Because the dollar is decoupled from gold, gold will no longer drag the dollar back, and the United States can print the dollar at will. If a large amount of US dollars remain in the US, it will cause inflation in the United States. If the US dollar is exported, it means that the whole world will digest inflation for the United States, which is the main reason why the inflation rate of the US dollar is not high.

In other words, the US dollar exports to the world also dilute its inflation.

But when the US dollar is exported to the world, the Americans will have no money. At this time, if the Americans continue to print money, the US dollar will continue to depreciate, which is not good for the US.

Therefore, the Fed is not a central bank that overprints money, as some people might imagine.

The Fed actually knows what restraint is.

How many dollars did the Federal Reserve issue from the establishment of the Federal Reserve in 1913 to the 100 year in 2013?

About 10 trillion.

In this comparison, some people began to accuse China's central bank.

Why? Our central bank has issued more than 120 trillion RMB yuan since 1954 when it issued new currency, new RMB.

If the exchange rate is 6.2 to the US dollar, we will probably issue $20 trillion.

But this does not mean that China is printing money because China has made a large amount of US dollars since its reform and opening up. Meanwhile, there are still a large number of US dollars for overseas investment to enter China.

However, due to foreign exchange control, the US dollar can not be circulated in China, so the central bank must issue RMB corresponding to the US dollar and other foreign currencies entering China, and then circulate the renminbi in China.

But foreign investment may be withdrawn after it earns money in China.

At the same time, we will also produce a large amount of foreign exchange, enough to buy resources, energy, products and technology from abroad. As a result, a large number of US dollars have gone, and the renminbi has been left behind. You can not destroy the corresponding amount of RMB, only let the RMB stay in China to continue to flow through, so the stock of China's RMB must be larger than US dollar.

This, in turn, has proved the amazing development of China's economy over the past 30 years.

The Central Bank of China has admitted that over 20 yuan has been exceeded in recent years.

Finally, all of the huge volume of super development remained in China, which would involve the question I would like to talk about later: why RMB should be internationalized.

The relationship between the dollar index cyclical law and the global economy

The reason why the United States does not have inflation depends largely on the global circulation of the dollar.

However, the United States can not release the dollar unchecked and let the US dollar depreciate.

So be moderate.

What can be done if there is no US dollar in the hands?

The Americans have another way to solve this problem, that is to issue treasury bonds, and to return the US dollar to the us through issuing treasury bonds.

But the output went back to the United States through debt capital, and Americans began to play the game of printing money with one hand, borrowing money at the same time, printing money to make money, borrowing money to make money, and making money with money. The financial economy is much more profitable than the real economy. Who else is willing to sweat a lot to do the manufacturing and processing real economy with low added value?

After August 15, 1971, Americans gradually abandoned the real economy and turned to virtual economy, and gradually became a hollow country.

Today, the US GDP has reached 18 trillion dollars, and the real economy contributes less than 5 trillion to its GDP. Most of the rest is virtual economy.

Through issuing treasury bonds, the United States returns a large number of US dollars circulating abroad to the United States, and enters the three major markets of the United States, the futures market, the Treasury bond market and the securities market.

Through this way, Americans generate money and then export it overseas, so that the United States turns into a financial empire.

The United States has integrated the world into its financial system.

Many people believe that after the decline of the British Empire, the colonial history is almost over.

In fact, because the United States became a financial empire, it began to use the US dollar to carry out covert colonial expansion. It controls the economy of every country through the US dollar, thus turning all the countries in the world into its financial colony.

Today we see many sovereign and independent countries, including China, you can have sovereignty, constitution, and government, but you can't get away from the US dollar. Everything will eventually be expressed in dollars by various means, and eventually your physical wealth will flow into the United States through the exchange with the US dollar.

In this regard, we can see very clearly through the chart of the US dollar index cycle over the past 40 years.

The decoupling of US dollars from gold in August 15, 1971 meant that Americans could get rid of the bondage of gold and print the US dollar at will. The US dollar issue increased significantly, and the US dollar index would naturally go down.

Since 1971, especially after the oil crisis in 1973, the US dollar index has been going down, which means that the dollar is much more printed.

It lasted for nearly 10 years.

The low US dollar index is not a bad thing for the world economy, because it means that the supply of US dollars increases, which means that the flow of capital increases, and a large amount of capital does not stay in the US, and it needs to spill over to foreign countries.

After the first low US dollar index, a large number of US dollars went to Latin America and brought investment to Latin America and brought prosperity. This is the economic prosperity of Latin America in 70s.

The US dollar flood period lasted for about 10 years. Until 1979, the Americans decided to close the floodgate.

The low US dollar index is equivalent to that of Americans sluice, and closing the gate is actually reducing the liquidity of the US dollar.

The US dollar index began to strengthen in 1979, which means sending us dollars to other places.

Latin America has been developing vigorously because of its large amount of US dollar investment. Suddenly, investment has been reduced, liquidity has dried up and the capital chain has been broken. Can the economy not be in trouble?

Battle of Ma Island

Latin American countries in trouble have begun to find ways to save themselves.

For example, Argentina, Argentina's per capita GDP has once entered the ranks of developed countries.

But with the emergence of the Latin American economic crisis, Argentina took the lead in recession.

There are many ways to solve the recession, but unfortunately, the government of Argentina was a military government on the coup.

As a soldier, the only idea in Canada is war, and he hopes to get rid of it through war.

He looked at the malware islands 600 kilometers away from Argentina, which the British call the Falkland Islands.

The archipelago has been ruled by the British for more than 100 years, and Canada has decided to take it back.

But Argentina is a South American country, and South America has always been regarded as the backyard of the United States.

The war in the US backyard can not help but ask the United States.

So in Canada, we have to speak to President Reagan and see the attitude of the United States.

Reagan knew clearly that the battle of the battle of Canada would lead to a more large-scale war with Britain, but he made a slight understatement that it was a matter between you and the United Kingdom. It has nothing to do with the United States. We do not hold a position. We remain neutral.

He thought that this was the tacit approval of the president of the United States. He launched the Falkland war and easily recovered Ma island.

Argentina is cheering and warmly like carnival.

But Mrs Thatcher, the prime minister, declared that she would never accept the outcome, and forced the president of the United States to declare it.

Reagan immediately tore off the mask of neutrality, issued a statement strongly condemning Argentina's aggressive behavior and resolutely stood on the side of Britain.

Subsequently, the United Kingdom sent an aircraft carrier special fleet, labor division expedition 8000 nautical miles, and seized the Horse Island in one fell swoop.

At the same time, the dollar trend began to strengthen, and international capital returned to the United States in accordance with the wishes of the United States.

Because when the horse island war started, investors around the world immediately judged that Latin America's regional crisis had emerged, and Latin America's investment environment had deteriorated, thus pulling out of Latin America.

When the Fed sees the timing, it immediately announces that the US dollar raises interest rates, and the US dollar after raising interest rates accelerates the withdrawal of capital from Latin America.

Latin America's economy is in a mess.

The capital pulled out of Latin America almost went to the United States, and pursued the three big cities of the United States (bond market, futures market and stock market), which brought the first big bull market after the United States and gold were decoupled from the United States, and made the Americans earn a full pot.

At that time, the US dollar index rose from more than 60 to more than 120 at a disadvantage, up 100%.

Americans do not take their hands behind their three big bull markets. They take the money they earn and go back to Latin America to buy high-quality assets that have fallen to floor price at that time, and cut the wool of Latin American economy once and for all. This is the first time the US dollar index has strengthened.

If this happens only once, it is a small probability event; if it happens again and again, it must be regular.

When the first "ten year dollar is weakening and the six year dollar is strong", people are not sure whether it is law or not.

From the peak of the Latin American financial crisis, the US dollar index began to decline again in 1986.

During the Japanese financial crisis and the European monetary crisis, the US dollar index is still going down for about 10 years, and the US dollar index strengthened again in 1997 after 10 years.

The US dollar index has strengthened for another 6 years.

This is very interesting. We can see that the dollar index almost shows such a regularity: 10 years of weakness, 6 years of strength, another 10 years of weakness, and the next 6 years of strength.

Asian financial turmoil

After the second weakening of the US dollar index in 1986, the US dollar poured into the world like floods for 10 years.

The main spillway area is Asia.

What was the most popular concept in the 80s of last century? "Asian four little dragons", "Asian geese" and so on.

At that time, many people believed that the prosperity of Asia was brought about by the hard work of Asians and the ingenuity of Asians. In fact, a great deal of the reason was that Asian countries got enough dollars and got enough investment.

When the Asian economy prospered almost to the same time, Americans felt that it was time to cut their wool again. So in 1997, after 10 years of low dollar index, the US dollar reversed its strength by reducing the supply of money to Asia. Most Asian enterprises and industries suffered from lack of liquidity. Some even broke the chain of funds, and there were signs of economic crisis and financial crisis in Asia.

At this time, a pot of water has burned to 99 degrees, and it is still 1 degrees before it can be boiled.

Is it also a battle like Argentines? Not necessarily.

Regional crisis is not necessarily the only way to fight.

Since the manufacturing regional crisis is to get rid of capital, there is still a way to create regional crisis without fighting. So we see that the financial speculator named Soros, taking his quantum fund and hundreds of hedge funds around the world, began to attack Thailand, the weakest country in Asia, by the wolves, attacking Thailand's currency baht.

About a week or so, the Thai baht crisis started immediately, and immediately produced a conductive effect. All the way to the south, one after another, it was sent to Malaysia, Singapore, Indonesia and Philippines, and then the North China, Taiwan, Hongkong, Japan and Korea were pported to Russia, and the East Asian financial crisis broke out.

The water has been boiled at this time.

Investors around the world judged Asian investment environment deteriorating and withdrew their capital from Asia.

The US Federal Reserve once again lost no time in blowing up the bugle of raising interest rates.

Once again, the capital pulled out of Asia by the trumpet went to the United States to chase the three largest city in the United States, bringing second big bull markets to the United States.

When Americans earn enough money, they still go back to Asia, like Latin America, with the large sums they earn from the Asian financial crisis, and buy Asia's premium assets on the floor price.

At this point, the Asian economy has been overwhelmed by the financial crisis. It has nothing to resist and no more to fight back. The only lucky person this time is China.

Aiming at China

Since then, as the tide is accurate, the dollar index has been weakening again after 6 years of strength, and then it began to weaken again in 2002. Then, it was 10 years later. By 2012, the Americans began to prepare for the weakening of the US dollar index.

The solution is still the same: creating regional crises for others.

Therefore, we have successively seen that the dispute over the Huangyan islands has occurred on the periphery of China.

Almost all of them were concentrated in this period.

But unfortunately, in 2008, the United States played with fire and played a big role. First, it suffered financial crisis, which forced the dollar index to be pushed back.

The Sino Philippine Huangyan dispute and the Sino Japanese Diaoyu Islands Dispute seem to have little to do with the strengthening of the US dollar index, but is it really all right?

Why exactly appear in the tenth year after the third weakening of the US dollar index? Few people have explored this issue, but this question is worth our deep consideration.

If we admit that after the decoupling of US dollars from gold in 1971, there really exists a cycle rate of US dollar index. According to this cycle rate and the way Americans use the opportunity to cut wool from other countries, we can conclude that it is now China's turn.

Why do we say so? Because at present, China has become the country that attracts and gets the most investment from the whole world.

From the perspective of economic laws, we should not just regard China as a country.

The scale of one China's economy is equivalent to that of Latin America, or even larger than that of Latin America. Compared with the East Asian economies, China's economy is equivalent to that of East Asia.

In the past ten years, a large amount of capital has entered China, making the total economic volume of China increase to second of the world at a coveted speed. So it is not surprising that the United States aimed at the target of third sheep shearing.

Hongkong central China Incident

If this judgement is established, then, after the Sino Japanese dispute over the Sino Japanese Philippine Islands and the Huangyan island dispute in 2012, China's surrounding events will emerge one after another until the Sino Vietnamese "981" drilling platform conflict last year, and then to Hongkong's "occupy China" incident.

Can these events be regarded as accidental events? In May 2014, the action of "occupy the middle" is in the process of brewing, and it will probably happen at the end of May.

However, it did not happen at the end of May, and did not happen at the end of June.

What is the reason? What is this "action" waiting for?

Let's compare the timetable for another event: the Fed's withdrawal from the QE timetable.

At the beginning of last year, the United States said it had to withdraw from QE (quantitative easing), but did not quit in April, May, June, July and August.

As long as we do not withdraw from the QE, it means that the US dollar is still being issued in excess, and the US dollar index can not be strengthened. Hongkong's "occupy the central position" has never appeared, and the two have completely coincided on the timetable.

Until the end of September 2014, the Federal Reserve finally announced that the United States had withdrawn from the QE, and the dollar index began to turn stronger. In early October, Hongkong accounted for the "middle" outbreak.

In fact, the four Diaoyu Islands, the Sino Philippine Huangyan Island, the 981 drilling platform and Hongkong "occupy the middle" are all exploding points. Any one point detonating successfully will trigger a regional financial crisis, which means that the investment environment around China will deteriorate.

In order to meet the "strong dollar index, other regions must have corresponding regional crisis, which worsens the investment environment in the region and forces investors to withdraw large amounts of capital", which is the basic condition of the US dollar profit model.

But unfortunately for the Americans, this time it met China's rival.

The Chinese used the way of Tai Chi to defuse the surrounding crisis. Until now, the last 1 degrees that Americans most hoped for at the temperature of 99 degrees had not been able to appear, and the water had never been boiled.

When the water was not boiled, the US Federal Reserve raised the horn to raise interest rates.

It seems that the United States knows that it is not so easy to cut wool from China, so there is no plan to hang it on a tree.

At the same time of pushing Hongkong to occupy the central position, the United States has been working together in other areas.

Ukraine crisis

The joint between the European Union and Russia.

Ukraine, led by Yanukovich, is certainly not an egg with no stitch, so there is a chance to make maggots fly.

But the United States focused on Ukraine not just because it is a slit egg, but it is enough to attack Yanukovich, a disobedient politician, and to block the approaching of Europe and Russia. It can also cause the deterioration of European investment environment and the ideal goal of three arrows.

Thus, a seemingly "Ukrainian" spontaneous "Color Revolution" broke out, and the goal of Americans was achieved in the way that Americans and the earth expected.

Putin, Russia's powerful man, took advantage of the opportunity to take back Crimea. Although this is not in the US plan, it just gives Americans more reason to put pressure on the European Union and Japan to force them to join the United States in the sanctions against Russia, which will give Russia even greater pressure on the European economy.

Why do Americans do this? People tend to look at it from a geopolitical perspective rather than from a capital perspective.

After the crisis in Ukraine, the relationship between Europe and the United States deteriorated rapidly, but the result of the sanctions imposed by the western world together directly worsened the investment environment in Europe and led to the withdrawal of capital from here.

According to the data, about one trillion dollars of capital left Europe.

The two hands of Americans are successful.

This is: if capital is not allowed to withdraw from China to pursue the United States, then at least let European capital withdraw and return to the United States.

The first step was achieved in a dramatic Ukraine situation, but the second step failed to achieve the desired goal.

Because the capital withdrawn from Europe did not go to the United States, and other statistics showed that most of them came to Hongkong.

This means that global investors are still not optimistic about the recovery of the US economy.

We prefer to look at China, which is already on the economic downturn, but still maintains the world's first growth rate.

This is one of them.

Second, the Chinese government announced last year that it will achieve "Shanghai and Hong Kong through". Investors all over the world are eager to make a profit in China through "Shanghai and Hong Kong through".

In the past, western capital did not dare to enter China's stock market. A very important reason is that China has strict foreign exchange control, so that you can come in freely, but you can't go out at random, so they are generally afraid to invest in China's stock market in China.

After the "Shanghai and Hong Kong links", they can easily invest in Shanghai's stock market in Hongkong. After making money, they can turn around and leave. So trillions of capital are stuck in Hongkong.

This is after September last year, that is, Hongkong's "occupy the middle" until today, "occupy the central force" and its behind the scenes pushing hands have always refused to give up, always want to return to a very important reason.

Because Americans need to create a regional crisis against China, so that capital stranded in Hongkong can be withdrawn from China to catch up with the US economy.

Why is the US economy so strong in need and dependent on international capital return? The reason is that after the decoupling of US dollars from gold in August 15, 1971, the US economy gradually abandoned physical production and left the real economy.

In the United States, the low-end manufacturing and low value-added industries of the real economy are called garbage industries or sunset industries, and are gradually shifting to developing countries, especially to China.

In addition to leaving the so-called high-end industries, IBM, Microsoft and other enterprises in the United States, about 70% of the employed population has gradually shifted to the financial and financial services industry.

At this time, the United States has become an Industrial Hollowing country, and it has not much real economy that can bring huge profits to global investors.

In this case, Americans have to open another door, which is the gateway to the virtual economy.

The virtual economy is its three largest city.

It can only generate money for its own money by allowing international capital to enter the financial pool of the three big cities.

Then, with the money earned to cut wool from all over the world, Americans now have only one way to live.

Or we call it the American way of life.

This way is that the United States needs a lot of capital flow to support the daily life of the Americans and the US economy. Under such circumstances, who is blocking the return of capital to the United States and who is the enemy of the United States.

We must understand this matter clearly.

Strict prevention of integration in Europe and Asia

In January 1, 1999, the euro was officially born.

Three months later, the war broke out in Kosovo.

Many people think that the Kosovo war was a joint attack by the United States and NATO on Milosevic's regime, because the Milosevic regime slaughtered the Albanians in the Kosovo area, creating an appalling humanitarian disaster.

After the end of the war, the lie quickly broke up, and the Americans admitted that it was a bureau jointly organized by the CIA and the western media to attack the Yugoslavia regime.

But is the Kosovo war really aimed at combating the Yugoslavia regime? The Europeans began to think this was the end, but after the 72 day war, European talent found themselves fooled. Why?

Kosovo War

At the start of the euro, Europeans were full of confidence.

They priced the euro at 1:1.07 against the US dollar.

After the outbreak of the war in Kosovo, the Europeans took part in NATO action, and gave full support to the United States to attack Kosovo, the 72 day bombardment, the collapse of the Milosevic regime and the surrender of the Confederacy.

But the next time, the Europeans found that they were wrong, and the euro was destroyed by the war in these 70 days.

At the end of the war, the euro plummeted 30%, or 0.82 dollars to one euro.

At this time, European talent suddenly realized that it was someone else who sold you, and you were counting money for others.

European talent began to wake up.

This is why when the United States wanted to fight Iraq later, the two European Union axis countries, France and Germany, were resolutely opposed to the war.

Some people say that Western democracies do not fight, so far, western countries did not have direct wars after World War II, but they did not mean that there was no military war, which did not mean that there was no economic war or financial war between them.

The Kosovo war was an indirect financial war against the euro by the Americans. The result was the fry and the euro.

Because the birth of the euro moved the cheese of the dollar.

Before the birth of the euro, the currency of the world was US dollars, and the US dollar settlement rate at the global level was as high as 80%, even now it is around 60%.

The emergence of the euro immediately cut off a large piece of cheese in the United States. The EU is a 27 trillion dollar economy, and its appearance suddenly overshadowed the largest trading area in the world, the North American Free Trade Zone ($24 trillion - 25 trillion US dollars).

In such a large-scale economy, the EU is certainly not willing to settle its internal trade in US dollars, so Europeans decide to launch their own currency, the euro.

The emergence of the euro has cut the amount of currency settled by US $1/3. Up to now, 23% of the world's trade settlement has used Euro instead of US dollar.

When Americans began to talk about the euro in Europe, they were not very vigilant. Later, it was too late to find that the euro appeared to challenge the hegemony of the US dollar.

Therefore, the United States should accept this lesson, on the one hand, to press the European Union and the euro, and to press other challengers on the other hand.

Destruction of Asia Pacific - the third largest economy

The rise of China has made us a new challenger.

The 2012 Diaoyu Islands Dispute and the Huangyan island dispute are the latest attempts by the United States to suppress challengers.

The two geopolitical events that have occurred around China have failed to cause capital outflows from China, but at least they have reached the goal of the United States, leading directly to two deaths.

At the beginning of 2012, negotiations between China, Japan and South Korea on the Northeast Asia free trade area were nearly successful; in April, the exchange of money between China and Japan and Sino Japanese mutual holding of each other's treasury bonds also reached an agreement.

However, at this time, the dispute over the Diaoyu Islands and Huangyan island came into being one after another, and the negotiations on Northeast Asia Free Trade Zone at one fell swash.

A few years later, we have barely completed the bilateral free trade area negotiations between China and Korea, which is of little significance, because it is totally different from the meaning of the China, Japan, South Korea and Northeast Asia free trade area. Why do we say so?

As the Sino Japanese ROK FTA negotiations are successful, it must be the entire Northeast Asia FTA including China, Japan, Korea, Hong Kong, Macao and Taiwan.

Once the Northeast Asian Free Trade Zone has been formed, it means that the world's largest third economies with about 20 trillion dollars have emerged.

However, the Northeast Asian Free Trade Zone will not stop once it appears. It will quickly integrate with the Southeast Asian Free Trade Area and form the East Asian Free Trade Area. The emergence of the East Asian Free Trade Zone means that the world's largest economy with more than 30 trillion dollars will emerge beyond the European Union and North America.

Next, we can continue to think that the East Asian Free Trade Zone will not stop. It will integrate West and India, and then integrate into five Central Asian countries, and then continue westward to integrate the middle east part of Western Asia.

So the whole FTA will exceed $50 trillion, which will be larger than that of the European Union and North America. If such a large FTA appears, will she be willing to settle their internal trade in euros or dollars? Of course not.

This means that Ya Yuan may be born.

But if there really is an Asian Free Trade Zone, we can only push forward the internationalization of the renminbi and let the renminbi become the dominant currency in Asia, just as the dollar will become the hard currency in North America and become the hard currency in the world.

The significance of RMB internationalization is far more than what we call the RMB going out and playing a role in the "one belt and one way". It will share three points with the US dollar and the euro.

Can the Chinese see this? Can Americans not see this? When the Americans declare that the strategic focus is moving eastward, pushing Japan to wrangle with China in the Diaoyu Islands and pushing Philippines to stand against China on Huangyan Island, if we are too short-sighted to think that the dispute over the Diaoyu Islands is the clash with China after the Japanese right-wing encourages the purchase of the island, the dispute over the Huangyan island is the trouble for president Aquino of Philippines to lose his head to China.

This is not the American foresight. It is another challenger that the Americans are trying to prevent the RMB becoming the US dollar. The Americans know very clearly what they are doing, so they must not let such things happen again.

Because the Northeast Asian Free Trade Area once formed will produce a chain reaction, which means that the world currency three points to become a reality.

If you want to see, is there only 1/3 currency hegemony in the hands of the dollar, also known as currency hegemony? And today, if the industry hollowing out of the United States, if there is no currency hegemony, can the United States be considered the world hegemony?

If you want to understand this, you will know why there are American shadows behind all the troubles that China has encountered today.

It is because the United States is far away from us and has a deep view, so as to prevent China from having trouble and make trouble everywhere.

This is the fundamental reason why the United States should implement the rebalancing of the Asia Pacific strategy.

What exactly does it need to balance? Is it really necessary to achieve a delicate balance between China and Japan, China and Philippines, China and other disputable countries and play a balancing role? Of course not, its goal is to balance the momentum of the rise of China's great powers today.

The US Army is fighting for the dollar!

People say that the strength of the United States is due to three pillars -- money, technology and military.

In fact, we can see today that the real support of the United States is money and military, while the support of the currency is the US military strength.

All countries in the world fight for money, but the US Army also burns money.

But they can burn money while making money for the United States, and this is a point that no other country can do.

The United States, only in the United States, can gain great benefits by fighting, even though the United States has lost its hands.

Iraq War

Why do Americans want to hit Iraq? Most people think of two words - oil.

Do Americans really fight for oil? No, no.

If Americans fight for oil, then why don't Americans pull a bucket of oil from Iraq after they hit Iraq?

And oil prices soared from $38 a barrel before the war to $149 a barrel after the war, and American civilians did not enjoy low oil prices because the US army occupied the oil producing countries like Iraq.

So the United States attacks Iraq not for oil, but for the dollar.

Why do I say so? The reason is very simple.

In order to control the world, the United States needs the whole world to use the US dollar.

In order to let the whole world use the US dollar, the Americans made a clever first move in 1973: let the US dollar be linked to oil, and through the coercion of OPEC's dominant country Saudi Arabia, realized the global oil paction with us dollar settlement.

If you understand that global oil deals are settled in dollars, you can understand why Americans fight in oil producing countries.

A direct consequence of fighting in oil producing countries is the surge in oil prices, and the surge in oil prices means that the demand for us dollars has also risen.

For example, before the war, you have 38 dollars in your hand. Theoretically, you can buy a barrel of oil from the oil traders.

Now the war has increased the price of oil by more than 4 times to 149 dollars. You only have 38 dollars in your hand to buy 1/4 barrels of oil, and the remaining 3/4 barrel means that you still have more than 100 dollars.

What do you do? You can only go to the Americans and take out their products and resources to exchange dollars for the Americans.

At this point, the US government will be able to stand upright, fair and square, and print the US dollar.

This is the secret of fighting US dollar demand through wars and fighting high oil prices in oil producing countries.

It is not just this goal that Americans fight in Iraq.

It is also maintaining the hegemony of the US dollar.

Why did George W. Bush have to fight Iraq in those days?

Now we have seen clearly that Sadam did not support terrorism, did not support al Qaeda or weapons of mass destruction, but why did Sadam finally walk to the gallows? Because Sadam thought he was smart and wanted to play with fire among great powers.

In 1999, when the euro was officially launched, Sadam thought that he had seized the opportunity to play with fire between the US dollar and the euro, the United States and the European Union, so he could not wait to announce that Iraq's oil deal would be settled in euros.

This provoked the American people, especially the series of demonstrative effects. Russian President Putin, Iran President Ahmadinejad and Venezuelan President Chavez announced that their country's oil export settlement was also settled in euros.

Is that not a stabbing knife in the chest of an American?

So this war in Iraq is a must. Some people think this is too far fetched.

So, let's take a look at what the Americans have done after they've gone to Iraq. Before we can catch Sadam, the Americans can't wait to set up the Iraqi interim government. The first decree issued by the interim government is to declare Iraq's oil exports, from the euro settlement to the US dollar settlement.

That's why Americans are fighting for the dollar.

Afghanistan war

Some may say that the war in Iraq can be understood for the sake of the dollar and that Afghanistan is not an oil producing country.

Moreover, after the "9. 11" war in Afghanistan, people all over the world saw clearly that the United States launched the war in Afghanistan in order to retaliate against al Qaeda and punish Taliban for supporting al Qaeda.

But is this really the case?

The war in Afghanistan started after more than a month after "9. 11". It should be said that the attack was very hasty. When the war was over, the US army fired the cruise missile, and the war continued. The US Defense Department had to order the nuclear arsenal, take out 1000 nuclear cruise missiles, take off the nuclear warheads, replace the conventional warheads, and fight more than 900 more to defeat Afghanistan.

This clearly proves that the preparations are very inadequate. Why do Americans rush to battle in this way?

Because Americans can't wait any longer, because Americans can't live longer.

In the early twenty-first Century, the United States, as an industry hollowed out country, needed about $700 billion net inflow every year to survive.

But within 9 months after "11.", the global investors' worsening of the investment environment in the US showed that they had never been worried and worried: if the United States can not guarantee its own security, how can it ensure the safety of investors?

As a result, about 300000000000 of the hot money left the United States.

This compels the United States to fight a war as soon as possible, not only to punish Taliban and Al Qaeda, but also to give global investors confidence.

As the first cruise missile exploded in Kabul, the Dow Jones index rebounded rapidly, recovering 600 points in one day, and the outflow of capital began to return to the United States. By the end of the year, about about 400000000000 dollars had returned to the United States.

This does not mean that the war in Afghanistan is also fighting for the dollar and fighting for capital.

Global rapid attack system

Many people are full of expectation for China's aircraft carrier, because they have seen the action in the history of aircraft carrier, and eagerly hope that China has its own carrier, and the appearance of the Liaoning does make our China catch up with the last bus of the carrier.

Although the aircraft carrier is still a symbol of a great power today, it is more of a sign.

Since the global economy is becoming more and more financial, the role of aircraft carriers will gradually decline.

Because in history, aircraft carrier is the product of logistics era.

When the British Empire prosper, it must promote global trade, push its products to the world, and then get the resources back, so it needs a strong navy to ensure the smooth passage of the sea.

Until later, the development of the aircraft carrier appeared to control the ocean and ensure the safety of the sea passage.

Because at that time, resources and products "logistics is king" era, who controls the ocean, who can control the flow of global wealth.

But today, the world is already the era of "capital is king". Hundreds of billions of billions of billions of capital will flow from one place to another. As long as several keys are knocked on the computer, it will be completed within a few seconds. The carrier on the ocean can follow the speed of logistics, but can not keep up with the speed of capital flow. Of course, it can not control global capital.

So what can be done today to keep pace with the flow, flow and flow of global capital supported by the Internet? Americans are developing a huge global rapid attack system, using ballistic missiles, supersonic airplanes, 5 times or even tens of times faster than supersonic cruise missiles, and can quickly attack any region where capital is concentrated.

Now the United States claims to be able to play the whole world in 28 minutes. No matter where capital is gathered anywhere in the world, as long as the US does not want capital to stay in that place, the missile can get there in 28 minutes.

And when the missile falls, the capital will withdraw.

This is why the global fast attack system will replace the carrier.

Of course, aircraft carriers will still have an irreplaceable role in the future, such as ensuring maritime safety at sea passage, or carrying out humanitarian missions, because aircraft carriers are very good offshore platforms.

But as a weapon to control future capital flows, it is far less than the global fast attack system.

Air sea battle

When considering the use of military means to deal with the rise of China, Americans put forward a concept called "air sea integration war".

But "air sea battle" is still difficult to solve the predicament of the United States.

"Air sea integrated warfare" is the concept of combat against China jointly proposed by the US Air Force and Navy leaders in 2010.

The idea of "air sea integration" is, in fact, the first manifestation of weakness in the US Army today.

The US Army used to think that it could strike China with air strikes, and the Navy could also attack China.

Now the United States finds that its own strength, whether air force or navy alone, can not constitute an advantage for China. It must combine air sea with China to form certain advantages, which is why the air sea is integrated.

But after more than 4 years of air sea battle in early 2010, Americans suddenly changed their name to the concept of "global public participation and mobile cooperation".

In the joint action plan of the air sea, Americans believe that there will be no war between China and the United States for 10 years.

After studying the development of China's military strength, the Americans consider that the existing capabilities of the US Army are not enough to ensure that the advantages of the Chinese army have been offset.

If we attack the ability of the aircraft carrier and destroy the capability of the space system, the United States must take 10 more years to develop a more advanced combat system to counteract some of China's advantages.

This means that the war schedule for Americans may be set in 10 years.

Although war may not happen in 10 years' time, we must be prepared for it.

If China wants no war in 10 years, we need to do our own things better in the next 10 years, including military and war preparations.

Along the way: China's Taiji!

Let's take a look at the popular sports in America, the first is basketball and the second is boxing.

The boxing sport typically reflects the American style of advocating strength, straight forward and heavy punches, and the best KO (knockout) opponent is clear.

Chinese people, on the contrary, prefer to be vague and flexible. I do not pursue KO, but I have to dissolve all your actions.

Chinese like tai chi, and Tai Chi is indeed a higher art than boxing.

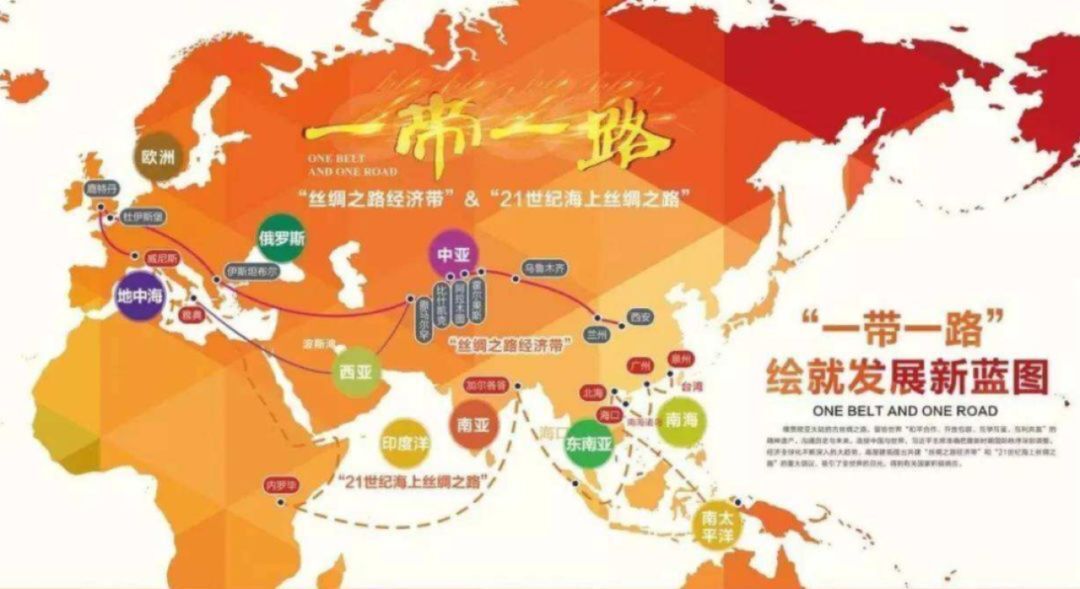

"One belt and one road" reflects this train of thought.

In the course of the rise of all great powers in history, there is a global movement around its rise.

This means that globalization is not a process from history to today, but globalization.

The Empire of Rome had the globalization of the Rome Empire, and the great Qin Empire had the globalization of the great Qin Empire.

Every globalization is driven by every rising empire.

Every Empire has a globalization related to it, and in its rising period to its heyday, globalization has reached its peak.

And this globalization will be limited by its own strength, which is the maximum extent of its ability and the farthest point that its pport can reach, that is the end of globalization.

Therefore, no matter the globalization of ancient Rome or the globalization of the great Qin Empire, today it can only be regarded as a regionalization process of imperial expansion.

The real globalization of modern history began with the great British Empire. The globalization of the British Empire is the globalization of trade.

After adhering to the mantle of the British Empire, the United States continued a period of trade globalization, and truly globalized with the characteristics of the United States is the globalization of the dollar.

This is also the globalization we are experiencing today.

But I do not agree that China's "one belt and one road" today is in line with global economic integration, which means that it is necessary to continue to integrate with the globalization of the US dollar.

As a rising power, "one belt and one road" is the initial stage of China's globalization, and also the globalization of China.

As a big country, we must promote globalization around you in the process of rising.

The "one belt and one way" should be said to be China's best strategy so far.

Because it is a hedge against the eastward shift of the US strategy.

Some people will ask this question. Hedging should be opposite. Do you still have a hedge against your back?

By the way, "one belt and one road" is China's backwards hedge against the US eastward shift strategy.

Didn't you press it?

I go west not only to avoid you, nor to fear you, but to cleverly dissolve the pressure from east to me.

"One belt and one road" is not a parallel strategy of two lines, but should be divided into primary and secondary ones.

In view of the fact that the sea power is still a short board in China, the "one belt and one road" should first be chosen from land. That is to say, "one way" should be the direction of auxiliary attack, and the "zone" should be the main direction of attack.

The "area" has become the main direction, which means we must reconsider the role of the army.

Some people say that the Chinese army is invincible. This is placed in the territory of China. Yes, the Chinese army is invincible and no one wants to set foot on China's territory to fight a massive battle. Is the Chinese army capable of expeditionary force?

The United States chose China as an opponent to suppress China. It chose the wrong opponent and chose the wrong way.

Because the real challenge to the United States in the future is not China, but the United States itself. The United States will bury itself.

Because it does not realize that a great era is coming. This era will bring the financial capitalism represented to the highest stage, and let the us fall from its peak, for on the one hand, the US has exhausted the dividend of capitalism through the virtual economy.

On the other hand, the United States, through its leading global technology innovation, has pushed the Internet, big data and cloud computing to the extreme, and these tools will eventually become the main drivers of burying the financial capitalism represented by the United States.

Internet +: cutting off the sword of US currency hegemony!

On the "double 11" of Alibaba last year, the sales volume of Taobao and Tmall networks reached 50 billion 700 million yuan a day, but in the three days of Thanksgiving holiday, the total sales volume of American online sales and shopping malls on the ground was equivalent to 40 billion 700 million yuan, less than that of Alibaba.

China has not yet counted NetEase, Tencent and Jingdong, but it does not calculate the turnover of other shopping malls.

This means that a new era has arrived quietly, and Americans are still slow to face this era.

Alibaba's pactions are all done in the form of Alipay. What does Alipay mean? It means that the currency has withdrawn from the trading arena, and the hegemony of the Americans is based on the US dollar.

What is the US dollar? The dollar is the currency.

In the future, when we stop using currency settlement more and more, the money in traditional sense will become useless.

When money becomes useless, will the Empire be built on the currency? That is the question that Americans should consider.

From the end of Qin Dynasty to the second Qin Dynasty, China began to have artificial rebellion, and Chen Shengwu launched the uprising. How many revolts, revolts, wars and revolutions have taken place in the history of the revolution of 1911 over the past 2000 years?

It has always been a low level cycle to solve the problem.

Because these dual movements can not change the nature of farming society, neither change the mode of production nor change the mode of paction, so it can only be changed for generations.

The same is true of the West. With the great power of the French Revolution, Napoleon led a new army that was baptized by the revolution to sweep Europe, and swept the top of the crown to the ground. But when the battle failed in Waterloo, Napoleon stepped down and the emperors of Europe restored to the feudal society one after another.

Until the British steam engine came, the industrial revolution came, so that human capacity increased greatly, a large number of surplus products appeared, and surplus products would have surplus value, then there would be capital, then there would be capitalists, then capitalist society would come.

Today, when capital is likely to disappear with the disappearance of money, mankind will soon step into a new social threshold. At this time, China and the United States stand on the same starting line, and are on the starting line of Internet, big data and cloud computing.

At this point, we have to compare with who will enter the era first, not who will suppress it.

The Americans, on the one hand, show astounding slowness.

Because it is too eager to maintain its hegemonic position, and never thought of sharing power with other countries, and jointly passing the new social era, today, for us, there are still many unknown areas and uncertainties.

- Related reading

Understand The Difference Between Pre Shrinking, Water Washing And Sand Washing By Feeling Differently.

|

A Cautionary Tale Of Entrepreneurs Who Advocate Social Media Marketing And Direct Marketing

|- Company news | H&M Home Series Officially Hits The Chinese Market

- Women's wear | Oscar De La Renta Released 2014 Autumn Winter Clothing Series

- Help you make money | Sales Promotion Skills Of Fashion Men'S Clothing Store

- Teach you to open a shop | Inventory Of Investment Underwear Stores Need To Master The Business Skills

- Commercial treasure | 如何把握休閑服裝品牌路線

- New product release | February Love Season Multi Brand Fashion Watches

- Jewelry store | Nomos Ahoi 腕表榮獲iF產品設計獎

- Fashion Library | Marc Jacobs 紐約2014秋冬系列時裝發布

- Management strategy | Analysis Of The Basic Quality Of The Successful Operation Of Clothing Brand

- Trend of Japan and Korea | Fresh, Charming, Korean, Beautiful And Romantic.

- The Delegation Of South Korea Went To The Samsung Clothing Survey: Planting Phoenix Trees To Attract Golden Phoenix

- Samsung Clothing: Providing Jobs To Help Tackle Poverty

- Samsung Garment Residential District Opened Today

- Samsung Introduce New System Of Clothing: Improve The Automation Level Of Garment Processing And Production

- Looking For The List Everywhere: The Textile Industry Chain "Overnight"! Haining, Changxin And Other Weaving Market Plan "Summer Vacation"! ...

- Canadian Organizations Question The Impact Of "Punching" Wet Wipes On The Environment.

- Technical Extension: The Key Points For Drawing And Setting Up Cotton Knitted Elastic Fabric

- Samsung Clothing: [Ambassador For Non Heritage Promotion] In Action] Li Aiping -- Tell The Red Story Of "General Tiger".

- Samsung Garment Co., Ltd.: Expansion Of Production Base To Open A New Morning Meeting Mode

- Samsung Garment Co., Ltd.: Expansion Of Production Base To Open A New Morning Meeting Mode